Comprehensive Guide To Jump Indices Trading (2024)

- Learn how to trade jump indices from Deriv which are popular worldwide

- Get to know the best jump indices brokers

- Learn about profitable strategies that you can use in jump indices trading

The jump indices from Deriv are designed to simulate markets with constant volatilities of 10%, 25%, 50%, 75%, and 100%.

On average, these synthetic indices have an equal probability of an up or down jump movement every 20 minutes. The average jump size is around 30 times the normal price movement.

There are 4 jump indices namely;

.

The numbers on the jump indices represent the levels of volatility.

For example, the jump 10 index has an average of three jumps per hour with uniform volatility of 10%. Likewise, the Jump 100 index has an average of 3 jumps per hour with uniform volatility of 100%.

This means that the jump 10 index is the least volatile and the jump 100 index is the most volatile.

Deriv is the only jump indices broker. This is because Deriv created the algorithm that controls the movement of the jump index. No other broker has access to this algorithm.

In other words, Deriv is the only:

Lot sizes determine the trade size you can place. Below are the minimum jump indices lot sizes.

Jump Index |

Smallest lot size |

| jump 10 Index | 0.01 |

| Jump 25 Index | 0.01 |

| Jump 50 Index | 0.01 |

| Jump 75 Index | 0.01 |

| Jump 100 Index | 0.01 |

To trade Jump indices in DMT5 you need to open a synthetic indices account in Deriv. Below are the steps that you follow to open the account.

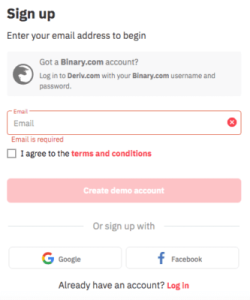

Start by opening your main Deriv account. This account will allow you to trade various markets like binary options, forex, and synthetic indices. You can open the Deriv main account here.

Enter your email in the box provided and click on “Create Demo Account“.

Deriv will send you an email to verify your email address. Open that email and click on the link to verify your email address and finish setting up your account. If you do not see the email try checking your spam folder.

Choose your preferred password & country of residence.

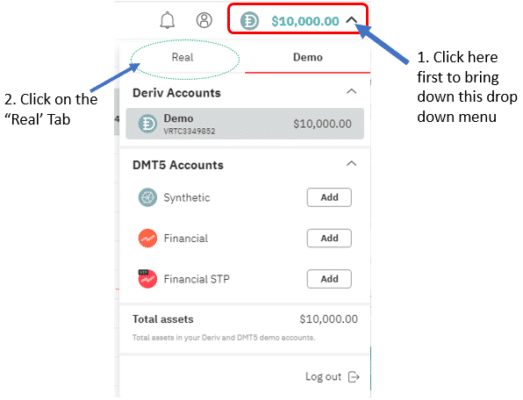

After verifying your email address, you will have a demo account on Deriv with $10 000 in virtual funds.

The next step is to do Deriv Real Account registration.

Log into the demo account that you created in the first step. Click the dropdown arrow beside the $10 000 demo balance and click on the ‘Real’ tab.

Next, click on the Add button and choose the default account currency. You will use this default currency to deposit, trade & withdraw and you can't change it after your first deposit. It is important to make sure you choose a currency that is convinient for you.

You will need to supply some details to finalise your Deriv real account registration. Enter the following details such as your real name, address & phone number.

Ensure that you use details that you can later verify. This is because as part of its Know Your Customer (KYC) policy, Deriv will ask you to upload your proof of residence and ID or passport.

These documents should have the same details as the ones you supplied during the registration.

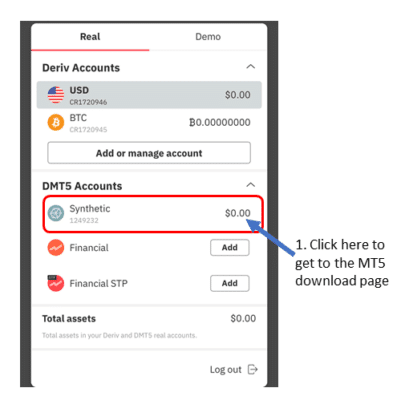

Next, you need to create a dedicated synthetic account to trade jump indices on DMT5.

Click on the ‘Real’ tab and then click on the Add button next to the synthetic account. Next, set the password for the synthetic indices account. It’s not the main account password, you will only use it to access the synthetic indices trading account.

After creating the account you will now see the account listed with your login ID. You will also get an email with your login ID that you will use to log in to the mt5 synthetic indices account.

Next you need to download the DMT5 platform.

To do this you must click on the synthetic account as shown below.

You will then be taken to a page with links to Metatrader 5 application for various systems like Android, Windows, iOS etc at the bottom of the page.

Download the one you want to use.

After downloading and installing your DMT5 you will then need to login to your trading account.

Click on Settings> Log in to new account.

You will need to enter the following details:

Broker: Deriv Limited

Server: Deriv-Server

Account ID: These are the numbers that you see next to your Synthetic indices account. You will also get this login id in the email that you get after opening the account

Password: Enter the password that you chose when you opened the synthetic account in step 3 above

Make sure you type these correctly because if you make mistakes you will not be able to connect to your trading account.

After logging in you can start trading.

No, you can't. You can only trade jump indices on DMT5. Deriv, the only broker with volatility indices, only uses MT5 servers.

Funding your volatility indices trading account with at least $50 will allow you to ride out any short-term reversals that may go against you.

There is no set minimum deposit amount needed to trade volatility indices. You can transfer as little as $1 from your main account to your DMT5 synthetic indices account.

However, the challenge with such a low deposit is that you will probably blow the account in seconds due to the volatility. You will also not be able to trade some of the jump indices due to margin and minimum lot size requirements.

This depends on personal preference. There are a variety of volatility indices that have different levels of volatility.

If you prefer high volatility you can choose assets like v75, v100, v200 (1s) or V 300 (1s).

For slower volatility, you can choose indices like v10 or v25. It is best to demo trade a variety of volatility indices so you can choose which ones you prefer.

Jump indices have uniform volatility around the clock. This means that you can trade them at any time of the day. This is different from forex where there are some periods with low volatility.

You just have to be on the lookout for the best setups.