Comprehensive Guide To Boom & Crash Indices Trading (2024)

- Learn how to trade boom & crash indices from Deriv which are popular worldwide

- Get to know the best boom & crash indices brokers

- Learn about profitable strategies that you can use in boom & crash indices trading

What are Boom & Crash Indices From Deriv?

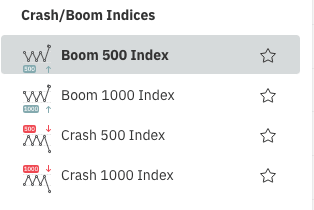

What Are The Different Types Of Boom & Crash Indices Offered By Deriv?

- Boom 300 Index

- Boom 500 Index

- Boom 1000 Index

- Crash 300 index

- Crash 500 Index

- Crash 1000 Index

Which Brokers Offer Boom & Crash Indices?

Deriv is the only broker that offers boom & crash indices because it owns the algorithm that moves these indices. No other broker has access to the algorithm.

In other words, Deriv is the only

- Boom 1000 index broker

- Boom 500 index broker

- Crash 1000 index broker

- Crash 500 index broker

- Boom 300 index broker

- Crash 300 index broker

Boom & Crash Indices Minimum Lot Sizes

Lot sizes determine the trade size you can place. Below are the minimum crash boom indices lot sizes.| Boom 1000 Index | 0.2 |

| Crash1000 Index | 0.2 |

| Boom 500 Index | 0.2 |

| Crash 500 Index | 0.2 |

Boom & Crash Indices Minimum Deposit & Margin Requirements

You can deposit as little as $1 to your synthetic indices account. However, you will not be able to tradecrash boom indices with such a low account balance.

The margin requirements and the minimum lot sizes needed to trade boom and crash will not allow you to place trades with such a low balance.

Below are the margin requirements and the minimum account deposit needed to trade the different boom and crash indices.

| Boom & Crash Index | Margin requirements for 0.2 lot size | Minimum advisable account balance required |

|---|---|---|

| Boom 1000 Index | $6.01 | $10 |

| Boom 500 Index | $2.51 | $5 |

| Crash 1000 index | $3.53 | $5 |

| Crash 500 Index | $3.72 | $5 |

How do you calculate boom and crash indices lot sizes?

📘 Need a Visual Guide With Boom & Crash Strategies?

We’ve put together a free PDF with real Boom & Crash chart examples, entry setups, and TP logic. Works great as a sidekick to this post.

How to Open a Boom & Crash Trading Account on Deriv

If you’re new to Deriv and want to trade Boom and Crash indices, getting started is simple — but you need to choose the correct account type and platform. Here’s how to do it step by step:

✅ Step 1: Create a Free Deriv Account

Go to 👉 The Deriv Sign_Up page and sign up using your email, Google, or Facebook.

You’ll receive a confirmation email — verify your account to proceed.

✅ Step 2: Open a Financial MT5 Account

From your Deriv dashboard (called Trader’s Hub), choose “DMT5” and open a Financial account.

⚠️ Note: Boom and Crash indices are now under the Financial account, not a separate “Synthetic or Derived” account like before.

✅ Step 3: Download the MT5 App

You can trade on MetaTrader 5 via:

- Desktop (Windows/Mac)

- Mobile app (Android/iOS)

- WebTrader (browser-based)

Get the app from your Trader’s Hub or search “MetaTrader 5” on your device’s store.

✅ Step 4: Login to MT5

Use the login credentials (not your email) provided under your Financial account.

Server name: Deriv-Server

Copy and paste your login + password into MT5 and connect.

🧠 Once you’re in, search for “Boom” or “Crash” in Market Watch to add the indices to your chart.

📘 Want help placing your first trade, setting stops, or adding indicators?

👉 Read: How to Trade Synthetic Indices on MT5

🧱 Understanding Market Structure (Before You Enter)

One of the biggest mistakes I made early on was trading Boom or Crash without looking at the bigger picture.

Just because M1 shows a sell setup doesn’t mean it’s time to click. If H1 is bullish and you’re shorting into a strong zone, you’ll get wiped out.

That’s why structure matters.

When you understand break of structure (BOS), retests, and trend direction on higher timeframes — your timing improves, and your stop-losses make more sense.

👉 Read the full Market Structure Guide (With Real Chart Setups)

Frequently Asked Questions On Trading Boom & Crash Indices

Can I trade boom & crash indices on MT4?

No, you can’t. You can only trade boom and crash indices on DMT5. Deriv, the only broker with volatility indices, only uses MT5 servers.

Which brokers have boom and crash?

Only Deriv has boom and crash indices because it created the algorithm that runs them.

What are crash and boom indices on Deriv?

Crash and boom indices on Deriv are synthetic indices that simulate the performance of markets that experience significant volatility. These indices are generated using a random number generator, and they are designed to provide traders with the opportunity to speculate on the direction of future price movements.

What are the different types of crash and boom indices offered by Deriv?

Deriv offers a variety of crash and boom indices, including:

Crash/Boom 1000: This index experiences a crash or boom every 1000 ticks on average.

Crash/Boom 500: This index experiences a crash or boom every 500 ticks on average.

Step indices: These indices have an equal probability of up or down movement in price series with a fixed step size of 0.1.

How do I trade crash and boom indices on Deriv?

To trade crash and boom indices on Deriv, you will need to create a trading account and deposit funds. Once you have done so, you can open a trade by selecting the crash and boom index you want to trade, specifying the amount you want to trade, and choosing whether you want to buy or sell.

What are the risks of trading crash and boom indices on Deriv?

Crash and boom indices are highly volatile, and there is a significant risk of loss when trading them. It is important to understand the risks involved before you start trading and to use risk management tools such as stop-loss orders to limit your losses.

What are the benefits of trading crash and boom indices on Deriv?

Trading crash and boom indices on Deriv offers several benefits, including 24/7 trading, low minimum trade sizes, and the ability to trade on both rising and falling markets.

Can I use leverage when trading crash and boom indices on Deriv?

Yes, Deriv offers leverage on crash and boom indices, which allows you to trade with a smaller amount of capital. However, leverage also increases the risk of losses, so it is important to use it wisely.

See our latest Articles on Synthetic Indices

💼 Recommended Brokers to Explore

Other Posts You May Be Interested In

AvaTrade Review 2024: 🔍Is AvaTrade a Good Forex Broker?

Overall, Avatrade can be summarised as a credible and trustworthy regulated broker with an overall trust rating of 94 [...]

What Is Deriv P2P (DP2P)? How to Fund & Withdraw Safely (Full Guide 2025)💳

👉 Don’t have a Deriv account yet? Click here to open yours now and start [...]

6 Best Copy Trading Brokers 2024: Profit From Social Trading 📈💡

Forex copy and social trading have grown in popularity over the last couple of years. [...]

HFM Premium Account Review

From lower spreads to personalized customer support, this article will provide a detailed review of [...]

Kiro: Free Binary Options Bot for Deriv Using Over 4 Strategy (2025)

If you’re searching for a Deriv over 4 bot to run on, Kiro is a [...]

🤖 Zuno: Deriv Under 9 Bot with Over 90% Win Rate & Safe Recovery 💵

If you’re searching for a free binary options bot to run on the Deriv platform, [...]