The Volatility index 75 (V75) is one of the most popular trading instruments on Deriv. It has consistently high volatility which presents chances for huge profits even in a short space of time.

I have been scalping V75 with great results for more than five years now, and in this guide, I will teach you how I do it.

In this guide, I’ll cover:

✔️ How V75 scalping works

✔️ The best indicators for V75 scalping

✔️ A step-by-step trading strategy with entry and exit points

✔️ Risk management techniques to avoid blowing your account

By the end you should have a proven scalping strategy that you can test for yourself.

What is Volatility 75 index on MT5?

V75 is a synthetic index offered by Deriv, a well-known forex broker. The index mimics a market with a constant volatility of 75%.

Volatility 75 is not affected by fundamentals like economic news or wars. Its movement is caused by an algorithm that is audited for fairness by third parties to ensure transparency.

V 75 trading is available anytime, even during the holidays and weekends.

Which Brokers Offer The V75 Index?

There is only one broker that offers V75 index.

That broker is Deriv. Deriv is the only broker to offer v75 because it is the one that created the algorithm that produces the numbers that move synthetic indices.

No other broker can offer the v75 index.

Where Can I Trade v75 Index?

You can only trade the V75 scalping trading strategy on DMT5 which is Deriv’s version of the popular MT5 platform.

If you do not have a DMT5 account you can open one by clicking the button below.

Open DMT5 AccountThis post also shows you how to open a synthetic indices account step-by-step.

What is Scalping?

Scalping is a short-term trading strategy where traders enter and exit trades multiple times in a short space of time, aiming to profit from small price movements.

V75 moves fast (high volatility) and, as such, scalping is a good strategy to use because:

✅It reduces market exposure and lowers the risk of huge losses

✅It allows traders to capitalise on small price movements, increasing the chances of profitability

✅Allows trading with tight stop losses, thereby reducing the risk of blowing your account.

V75 Scalping Trading Strategy Overview

Trading Type: Scalping

Timeframes: 5 minutes (M5), 15 minutes (M15), 30 minutes (M30) and 1 hour (H1)

Trade Execution Timeframe: 5 minutes (M5)

Signal Detection Timeframe: 15 minutes (M15)

Confirmation Timeframe: 30 minutes (M30) and 1 hour (H1)

Indicators: Bollinger Band, Relative Strength Index (RSI), Stochastic Oscillator and MACD

Below is a table showing the function(s) of all indicators to be used in the v75 scalping trading strategy:

| INDICATOR | FUNCTION |

| Bollinger Band | Measures Volatility |

| Relative Strength Index (RSI) | Measures Market Exhaustion |

| Stochastic Oscillator | Measures Momentum |

| MACD | Direction and Momentum |

Steps to Taking a Trade Using The V75 Scalping Trading Strategy

1. Set up all indicators on your DMT5 app. Please ensure all parameters are 100% correct and check again to confirm.

2. To detect a potential trading signal for further analysis, switch your chart to M15 (15-minute timeframe).

Sell Signal Using The V75 Scalping Trading Strategy

✅Stochastic Oscillator (Blue Line) must reach the 80 level

✅RSI (Black Line) must reach the 70 level

✅MACD histogram forms a peak

✅The price must touch the upper Bollinger Band

✅ Candlestick rejection forms

✅ Check again to be sure

Another example of a sell trade using the V75 strategy.

Buy Signal Using The V75 Scalping Trading Strategy

✅ Stochastic Oscillator (Blue Line) must reach the 20 level

✅RSI (Black Line) must reach the 30 level

✅MACD histogram forms a trough

✅The price must touch the lower Bollinger Band

✅ Candlestick rejection forms

✅ Check again to be sure

Another example.

3. When all the conditions for sell or buy are met on M15, draw a straight line to mark out the anticipated reversal point.

4. After drawing a line on M15, move to M5 for further confirmation of The V75 Scalping Trading Strategy .

Take the following actions if you see any of the following on M5:

- Scenario 1 All the conditions met on M15 are also met M5 Action: Mark as HIGH POTENTIAL SET UP

- Scenario 2 All the conditions met on M15 are not met on M5 Action: DISCARD TRADE IMMEDIATELY AND WAIT FOR ANOTHER SIGNAL ON M15

- Scenario 3 All the conditions of the V75 Scalping Trading Strategy met on M15 are about to be met on M5 Action:

WAIT PATIENTLY FOR COMPLETE SIGNAL FORMATION ON M5 BEFORE ENTERING

In the case of Scenario 1, you must carry out the following simple analysis before entering your trade:

✅ Switch to M30 and H1 timeframes to check if the price is moving in a direction opposite to your short-term prediction. If it is, DON’T ENTER ATRADE. This is because a strong fake reversal might occur which will most likely hit your stop loss.

Example: The conditions for SELL have been met on M15 and confirmed on M5. But when you checked M30 and H1, you noticed that the BUYING POWER is high. This means price might not respect the signal and move along with the trend instead.

✅ To detect the trend direction on both M30 and H1, you will check the crossover on the Stochastic Oscillator and MACD histogram formation.

- BUY BIAS: Stochastic Blue line crosses the Red and moves upward, while the MACD predicts an upward movement.

- SELL BIAS: Stochastic Blue line crosses the Red and moves downward, while the MACD predicts a downward movement. 6. If all these conditions are met, you can safely enter your trade on M5.

How To Enter A Trade Using The V75 Scalping Trading Strategy

1. All trades should be executed and monitored on M5 only.

2. Before entering a trade, decide on the lot size to use depending on the size of your account. Make sure you understand risk management.

3. The V75 scalping trading strategy, does not use the Instant Execution option, instead, it uses Stop Orders (SELL STOP or BUY STOP). This will prevent premature entry.

4. When all your signals have formed on all timeframes, switch to M5 and place a STOP ORDER a few PIPS below (For a SELL TRADE) or above (For a BUY TRADE).

5. Stop loss should be placed a few pips above the highest or lowest candlestick (depending on the type of trade). Note that there is always a possibility of a retest before the final movement.

WARNING: ALWAYS SET STOP-LOSS AND DON’T USE A LOT SIZE THAT IS BIGGER FOR YOUR ACCOUNT SIZE!

How To Exit A Trade Using The V75 Scalping Trading Strategy

There are methods you can use to determine when the movement is done.

1. The Bollinger Band

✅Price reaches the middle band or

✅ Price reaches the last band

2. The Stochastic Oscillator

✅The blue Stoch line touches the opposite level e.g. For a SELL trade, the line moves from 80 level and approaches 20.

Vice versa for BUY.

3. Constant PIP target per trade

✅I target 100 pips per trade irrespective of the movement. This is 1000.0000 points per trade based on observation.

✅ You must monitor 1 and 2 to determine when not to opt out of a trade prematurely.

Rules of The V75 Scalping Trading Strategy

1. Don’t be greedy. Make use of stop-loss and appropriate lot size.

2. Your total opened positions should be equivalent to your normal lot size depending on your capital.

3. Have a daily profit target to eliminate greed or overtrading.

4. If a signal is incomplete, don’t trade it.

5. If you are not confident with the strategy, don’t trade it.

6. Make sure you read articles on all indicators during your back-testing period.

7. Don’t trade an amount you can’t afford to lose.

8. Be confident in yourself as a trader.

9. If you are a new trader and you are not familiar with any of the terms mentioned above, please Google them

10. Trading is risky irrespective of the strategy. Follow these tips for better chances of making a profit.

Risk management for V75 Scalping

✅ Use proper position sizing: Risk 1-2% per trade

✅ Don’t overtrade: A maximum of 5 trades over a session is advisable

✅ Document your trades: Keep a journal so you can see the trends over time and improve your trading

✅ Set a daily stop loss: Stop trading after three consecutive losses

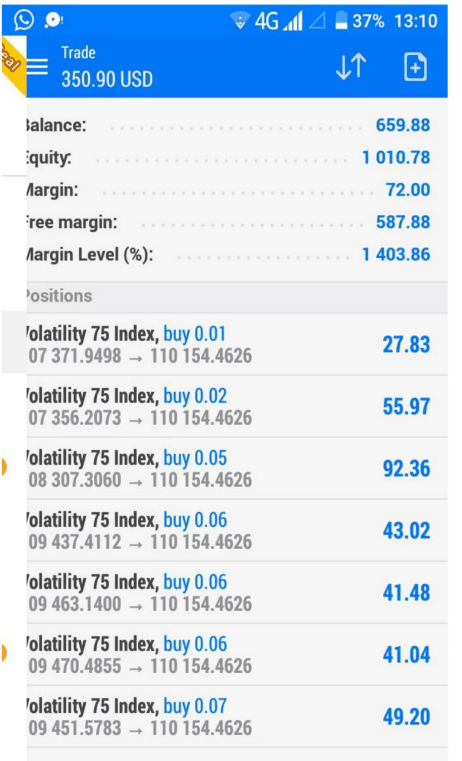

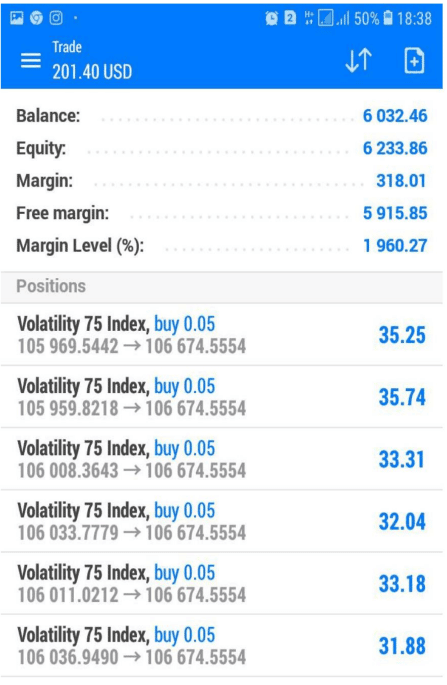

Below are screenshots showing some of the results of using this strategy.

Another one.

And another.

This strategy has the potential to give you good profits that you can withdraw and enjoy! You can also check out these other tips for trading synthetic indices profitably.

I would advise you to test this strategy on demo first for about a month before going live so you understand how it works.

Leave your thoughts about this strategy below in the comments.

💼 Recommended Brokers to Explore

Other Posts You May Be Interested In

What Is Deriv P2P (DP2P)? How to Fund & Withdraw Safely (Full Guide 2025)💳

👉 Don’t have a Deriv account yet? Click here to open yours now and start [...]

Top Platforms for Trading Synthetic Indices on Deriv: A Complete Guide

When I started trading Deriv’s synthetic indices in 2016 I stuck exclusively to MT5 because [...]

How to Open a Deriv Demo Account on MT5 – Step-by-Step Guide (2025) ✔

Introduction: Why Open A Deriv Demo Account Using a demo account is a safe way [...]

Exness Review 2024: 🔍 Is This Forex Broker Legit & Reliable?

Overall, Exness can be summarised as a well-regulated and reliable broker that has competitive trading fees and instant [...]

Download Our Free Boom & Crash Strategy PDF (2025 Update)

I get asked this a lot — “Do you have a Boom & Crash Strategy [...]

XM Copy Trading Review 2024: Profit From Other Traders! ♻

In this review, we will explore XM Copy trading, evaluating its features, benefits, and overall [...]