What Are Multipliers From Deriv?

Multipliers from Deriv offer a great way of limiting risk and increasing potential profits from your trades. When the market moves in your favour, your potential profits will be multiplied. If the market moves against your prediction, your losses are limited only to your stake.

For example, let’s suppose you predict that the market will go up and you stake $100.

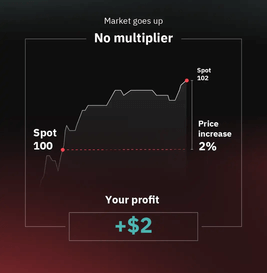

Without a multiplier, if the market goes up by 2%, you’ll gain 2% * $100 = $2 profit.

With a x500 multiplier, if the market goes up by 2%, you’ll gain 2% * $100 * 500 = $1,000 profit.

So with Deriv multipliers, you have the opportunity to magnify your profits while you will only lose your stake should the trade go against you.

This is one advantage of trading synthetic indices.

How To Trade Multipliers Using Synthetic Indices On DTrader

Define your position

1. Market

- Start by opening your Deriv account

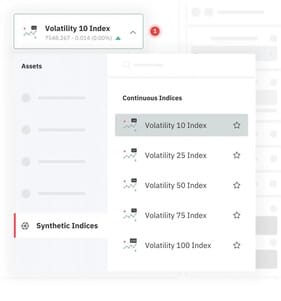

- Log in to your Deriv account and start by choosing the synthetic index you want to trade using multipliers. You can also trade multipliers using other markets like currencies

2. Trade type

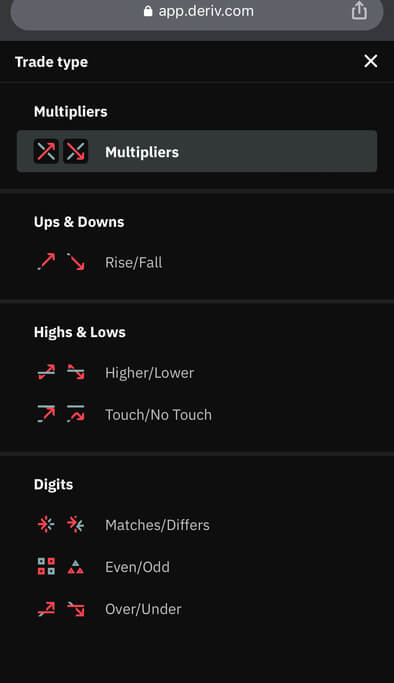

- Choose ‘Multipliers’ from the list of trade types.

3. Stake

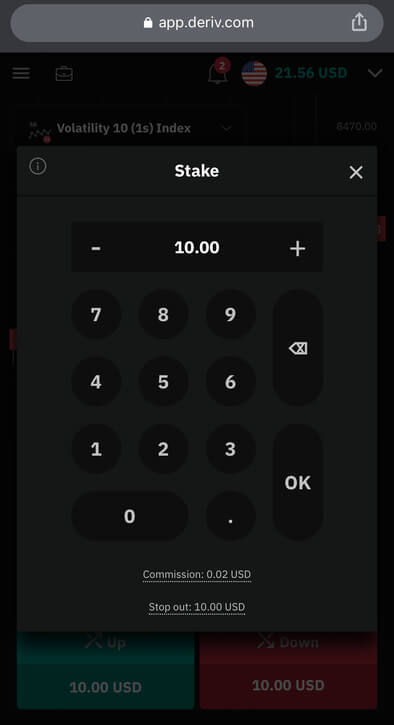

- Enter the amount you wish to trade with. This is the amount you are willing to risk in the trade

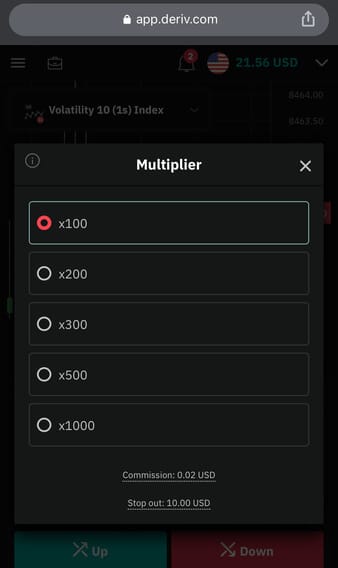

4. Multiplier value

- Enter the multiplier value of your choice from x100 to x1000. Your profit or loss will be multiplied by this amount.

Set optional parameters for your trade

5. Take profit

- This feature allows you to set the level of profit that you are comfortable with when the market moves in your favour. Once the amount is reached, your position will be closed automatically and your earnings will be deposited into your Deriv account.

6. Stop loss

- This feature allows you to set the amount of loss you are willing to take in case the market moves against your position. Once the amount is reached, your contract will be closed automatically.

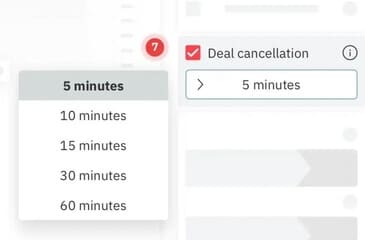

7. Deal cancellation

- This feature allows you to cancel your contract within one hour of buying it, without losing your stake amount. Deriv charges a small non-refundable fee for this service.

8. Purchase your contract

- Once you are satisfied with the parameters that you have set, select either ‘Up’ or ‘Down’ to purchase your contract. Otherwise, continue to customise the parameters and place your order when you are satisfied with the conditions.

Things to keep in mind when trading multipliers using synthetic indices

Stop out

With or without a stop loss in place, Deriv will close your position if the market moves against your prediction and your loss reaches the stop-out price. The stop-out price is the price at which your net loss is equal to your stake.

Multipliers on Crash and Boom

Deal cancellation isn’t available for Crash and Boom indices. The stop-out feature will close your contract automatically when your loss reaches or exceeds a percentage of your stake.

The stop-out percentage is shown below your stake on DTrader and varies according to your chosen multiplier.

You can’t use stop loss and deal cancellation features at the same time.

This is to protect you from losing your money when using deal cancellation. With deal cancellation, you are allowed to reclaim your full stake amount if you cancel your contract within an hour of opening the position.

Stop loss, on the other hand, will close your contract at a loss if the market moves against your position. However, once the deal cancellation expires, you can set a stop loss level on the open contract.

You can’t use take-profit and deal cancellation features at the same time.

You can’t set a take-profit level when you purchase a multipliers contract with deal cancellation. However, once the deal cancellation expires, you can set a take profit level on the open contract.

Cancel and close features are not allowed simultaneously.

If you purchase a contract with deal cancellation, the ‘Cancel’ button allows you to terminate your contract and get back your full stake. On the other hand, using the ‘Close’ button lets you terminate your position at the current price, which can lead to a loss if you close a losing trade.

Advantages Of Trading Multipliers on Deriv Using Synthetic Indices

Better risk management

- Customise your contracts to suit your style and risk appetite using innovative features like stop loss, take profit, and deal cancellation.

Increased market exposure

- Get more market exposure while limiting risk to your stake amount.

Secure, responsive platform

- Enjoy trading on secure, intuitive platforms built for new and expert traders.

Expert and friendly support

- Get expert, friendly support when you need it.

Trade 24/7, 365 days a year

- Offered on forex and synthetic indices, you can trade multipliers 24/7, all year round.

Crash/Boom indices

- Predict and gain from exciting spikes and dips with Crash/Boom indices.

Disadvantages Of Trading Multipliers on Deriv Using Synthetic Indices

- Increased Risk of Losses:

Multipliers amplify both gains and losses, meaning that even small market movements can lead to significant losses. This high volatility can quickly wipe out your investment capital if the market moves against your prediction.

- Psychological Impact:

The potential for substantial losses can take a toll on your emotions, leading to impulsive decisions and poor risk management. The constant pressure of potential losses can be psychologically stressful and detrimental to your trading decisions.

- Limited Control over Losses:

Despite Deriv’s risk management features like stop-loss orders, you may still incur losses that exceed your initial investment due to slippage or unexpected market movements. This limited control over losses can be a significant disadvantage.

- Only Suitable for Experienced Traders:

Multiplier trading is complex. This means that it is suitable for experienced traders with a high-risk tolerance and a deep understanding of market dynamics. Beginners and risk-averse individuals should avoid multiplier trading.

- Risk management features cannot be used simultaneously

Certain risk management features cannot be used simultaneously. For example, you cannot use Stop-Loss simultaneously if you have Deal Cancellation active. You also cannot use Cancel, and close features at the same time. This increases your risk of loss.

Tips for trading multipliers on Deriv

- Start with a small stake amount and gradually increase it as you become more comfortable with multiplier trading.

- Use stop-loss orders to limit your potential losses.

- Do not trade more than you can afford to lose.

- Understand the risks involved before trading multipliers.

- Use a demo account to trade multipliers and learn more about them.

Is multiplier trading on Deriv suitable for beginners?

No, multiplier trading on Deriv is not suitable for beginners. Multiplier trading is a high-risk investment, and beginners should not engage in this type of trading unless they have a deep understanding of market dynamics and a high-risk tolerance.

FAQ’s On How To Trade Multipliers Using Synthetic Indices From Deriv

Multipliers on Deriv are financial instruments that allow you to amplify your position’s potential returns. They provide the opportunity to trade with a leverage effect, allowing you to control a larger position size with a smaller initial investment.

When you open a trade with a multiplier, your potential profit or loss is multiplied by the selected multiplier value. For example, if you open a trade with a 10x multiplier and the trade results in a 5% profit, your actual profit will be 50% (5% x 10). However, it’s important to note that multipliers also amplify losses, so you need to be cautious and manage your risk effectively.

Multiplier trading is a high-risk investment, as it involves the potential for magnified losses. This is because multipliers amplify both gains and losses. Even small market movements can lead to significant gains or losses, which can quickly wipe out your investment capital if the market moves against your prediction.

Trading with multipliers involves higher risks due to the amplified potential losses. It’s crucial to implement effective risk management strategies, such as setting stop-loss orders to limit your potential losses, diversifying your trades across different assets, and avoiding excessive leverage. Additionally, it’s essential to have a thorough understanding of the assets you’re trading and to stay updated on market conditions.

Yes, Deriv provides a demo account feature that allows you to practice trading with virtual funds. You can use the demo account to familiarize yourself with trading multipliers and test your strategies without risking real money. It’s recommended to gain sufficient experience and confidence in trading with multipliers before transitioning to a live trading account.

💼 Recommended Brokers to Explore

Other Posts You May Be Interested In

Deriv Jump Indices: A Comprehensive Beginners Guide (2025) 📊

📅 Last updated: June 26, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Taylor [...]

AvaTrade Account Types Review 2024: 🔍 Which One Is Best?

📅 Last updated: December 8, 2023 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Taylor [...]

Advantages & Disadvantages of Trading Synthetic Indices on Deriv in 2025 💹

📅 Last updated: June 12, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Taylor [...]

Volatility Indices on Deriv: Full Guide to Types, Lot Sizes, Volatility Levels & Best Strategies (2025)

📅 Last updated: June 23, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Taylor [...]

How To Contact Deriv Support (Updated Guide 2025) 📞💬

📅 Last updated: June 21, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Taylor [...]

MT5 vs Deriv X: Which Platform Should You Use in 2025? 💻

📅 Last updated: June 27, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Taylor [...]