Are you looking for no loss Deriv bots?

I completely get you.

When I started out, I was also hunting for that foolproof, stress-free, 100% guaranteed system — a way to win without ever having to worry about losses. And honestly?

I fell for more traps than I care to admit. Scripts that promised the world. Systems that seemed unbeatable… until they weren’t.

That was over ten years ago.

Since then, the hype has only gotten louder — especially now with TikTok and Pinterest flooded every week with flashy videos claiming to have “cracked the code.”

Just plug in this secret bot, they say, and watch it print money non-stop. No losses. No stress.

Sounds perfect, right?

But if you’re seriously searching for a no loss Deriv bot, you need to understand something upfront: there’s no such thing as a no-loss bot. Not on Deriv. Not anywhere.

What does exist are recovery tools — smart, calculated strategies that help you bounce back if you understand the risks and use them with discipline.

The reality is, the financial markets we trade are way too complex and unpredictable for any system to guarantee zero losses. Even the best trading strategies — the ones used by professionals with years of experience and sophisticated tools — still suffer losses from time to time, and some of those losses can be very significant.

If you’re aiming for perfection, you’re chasing a myth.

If you’re aiming for consistency with proper risk control, you’re on the right path.

This guide isn’t some hype pitch.

It’s drawn directly from my personal experience — what actually works, what’s fantasy, and how to protect your account when using recovery bots the right way.

Let’s dive in.

Read Review

OPEN AN ACCOUNT

Read Review

OPEN AN ACCOUNT

Min Deposit: USD 1

Total Pairs: 100+

Regulators: MFSA, LFSA, VFSC, BVIFSC

What Is a “No Loss” Deriv Bot? And Why It’s a Trap

When people talk about “no loss bots,” they usually mean scripts or bots that:

- Keep increasing stake until they win

- Promise 94–100% win rate with a few button clicks

- Claim to work with any balance, on any market, any time

Most of these bots come from:

- TikTok videos showing cherry-picked sessions

- Telegram channels selling “VIP versions” for $5 or less

- Code repost sites with no explanation or safety guardrails

What they don’t show?

👉 Blown accounts.

👉 Loss streaks that wiped 3 months of gains in 30 seconds.

👉 Or the fact that Deriv can pause, delay, or reject trades when tick volumes are high.

Let’s get real. A bot that tries to recover doesn’t mean it can do it forever. And the ones that chase every loss blindly are the ones that bury your account in the blink of an eye.

How Real Recovery Systems Actually Work

Not all recovery methods are bad. In fact, if you use the right one with proper limits, they can help you manage small drawdowns and hit steady targets. Let’s break down the two big ones.

🔴 Martingale (Fast, Risky)

This is the classic doubling system:

You lose $1 → next stake is $2

Lose again → $4

Then $8 → $16 → $32… and so on

✅ Pros:

- Quick recovery if the win comes early

- Works well on bots with a 90%+ win rate

❌ Cons:

- One bad streak = game over

- You need huge capital to absorb 6–10 losses

- Pressure builds with each loss, especially emotionally

Example: Lose 6 times in a row starting with $0.35 → your next stake is $22.40. Most traders don’t even have that left.

🟢 PLS (Progressive Loss Scaling)

This is what we use on bots like Varus, Zuno, and Axon. Instead of doubling, we increase the stake slowly — based on controlled risk.

For example:

- Start: $0.35

- Lose → $0.70

- Lose again → $1.10

- Then back to base on a win

You can tweak the recovery steps, add buffers, and stop if needed.

✅ Pros:

- Much safer for small accounts

- Easy to recover without risking full balance

- Works great when paired with smart entry timing

❌ Cons:

- Slower recovery = more patience required

- Still needs discipline — or you’ll spiral on a bad day

PLS vs Martingale — Head-to-Head Comparison

| Feature | Martingale | PLS |

|---|---|---|

| Recovery Speed | Fast | Moderate |

| Risk per loss | Grows rapidly | Grows slowly |

| Suitable for | Big balances | Small to mid accounts |

| Max loss protection | Low | High |

| Mental stress | High | Manageable |

| Real-world use | Rarely sustainable | Works with caps & logic |

No Bot Is Truly No-Loss. Here’s Why.

Markets — even synthetic ones — don’t move in your favor just because you want them to.

There are days where digit patterns shift unpredictably, volatility spikes, or the bot gets caught in a bad sequence. That’s normal. What matters is how your setup handles it.

Some reasons bots still lose:

- Entry timing is off (bad signal)

- You ignore a stop-loss or session limit

- Your internet delays or Deriv throttles execution

- You blindly trust a system with no real testing

If your bot doesn’t have an exit plan, a cap, or logic for when to stop… you’re not trading. You’re gambling.

Real Session Results: What a Recovery Bot Actually Looks Like

Let’s talk numbers — not promises.

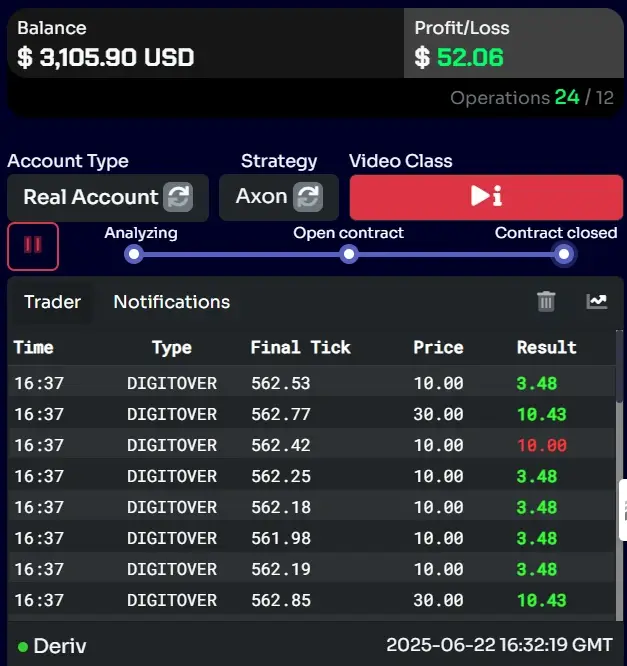

Session A (Axon – Over 2 bot)

- 🟢 36 trades → 24 wins, 12 losses

- PLS recovery engaged after each dip

- Profit: $52.06 in under 5 minutes

Want to see how the Axon bot works under the hood?

This Over 2 strategy thrives when low digits (0–2) are quiet — and it recovers quickly using PLS when they spike. You can learn exactly how it enters trades, when it recovers, and how to set it up for your account size.

👉 Read the full Axon bot guide here

✅ You’ll be able to demo trade it yourself in under 5 minutes.

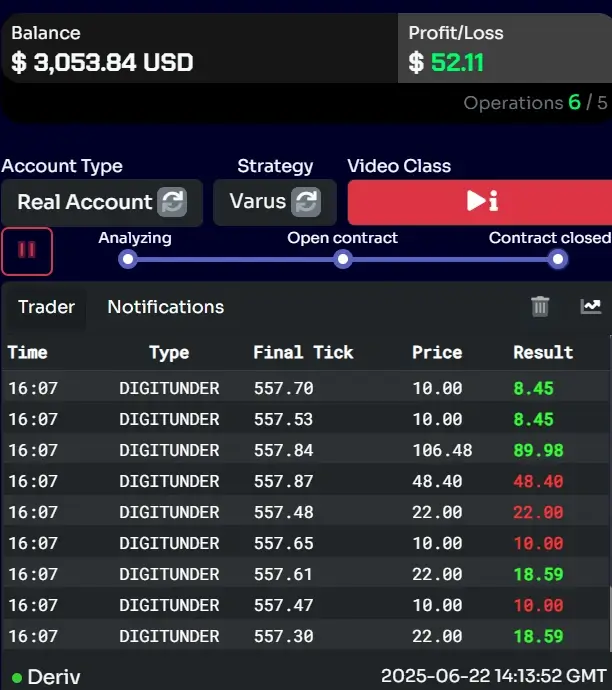

Session B (Varus – Under 5 bot)

- 🟢 11 trades → 6 wins, 5 losses

- Steady recoveries, no stress

- Profit: $52.11 in 4 minutes

These aren’t flukes. They’re what happens when a recovery bot is used with:

- Proper entry conditions

- Reasonable targets

- Clear exit limits

No magic. Just logic.

Curious how the Varus bot keeps bouncing back from losses?

This Under 5 bot takes smart entries when high digits (5–9) dominate — and uses a safer recovery method to climb back after dips. If you want to understand the logic and test it risk-free on a demo account, start here:

👉 Read the full Varus bot guide here

✅ You’ll be able to start running it on demo in just 5 minutes.

Safe Bot Configurations for Small & Medium Accounts

Here’s a cheat sheet to keep your recovery realistic and manageable:

💰 $10 Account

- Base Stake: $0.35

- Daily Target: $0.90

- Max Safe Losses: 4

- Recommended Bot: Varus or Zuno

👉 Read how the Zuno (Under 9) bot works here — it’s a safe starter bot that switches to Under 5 when needed.

💰 $30 Account

- Base Stake: $0.50

- Daily Target: $1.50–$2.00

- Max Safe Losses: 6

- Recommended Bot: Axon or Varus

💰 $50 Account

- Base Stake: $0.75

- Daily Target: $2.50–$3.00

- Max Safe Losses: 7

- Recommended Bot: Axon or Kiro

👉 Read how the Kiro (Over 4) bot works here — it targets digits 5–9 and recovers smartly when the 0–4 range fades.

💰 $100+ Account

- Base Stake: $1.00–$2.00

- Daily Target: $4.00–$8.00

- Max Safe Losses: 8–10

- Recommended Bot: Any (with PLS enabled)

✅ Tip: Start with demo, test for 2–3 days, and only go live once you’ve hit target consistently.

✅ Stop once your daily profit is reached — don’t let greed reverse the gains.

Final Thoughts — No Magic, Just Management

You’ll see the hype. No loss Deriv Bots promising the moon. Recovery plans that “never fail.”

But what actually works?

✅ Smart entry timing

✅ PLS-based recovery

✅ Discipline to stop

It’s not flashy, but it’s repeatable. That’s what real trading is about.

✅ Want to try recovery bots with proper safety logic?

Before you dive in, make sure to go through our step-by-step setup guide — it walks you through everything:

- How to create and connect your Deriv account

- How to set tick duration correctly

- Risk management tips to avoid blowing your balance

- Why journaling is essential and how to do it

- Full setup screenshots for beginners

👉 Read the full setup guide here:

https://synthetics.info/connect-deriv-account-bot-platform/

Once you’re ready…

👉 Access our recommended bot platform here

It’s completely free to use, works with both demo and real accounts, and includes all five recovery bots (Zuno, Kiro, Varus, Axon, Orix) ready to trade.

Switch between bots, test strategies, and manage risk — all in one place.

💬 What’s Been Your Experience with the “No Loss” Bot Hype?

Have you ever chased a so-called “no loss” Deriv bot? What happened — and what did you learn?

We’d love to hear your story. Whether it worked for a while or ended in losses, your experience can help others avoid the same mistakes. If you could give one piece of advice to a newbie searching for these bots today, what would it be?

👇 Drop your thoughts in the comments — someone out there needs to hear it.

❌ Still Searching for “No Loss Deriv Bot Free Download”? Here’s What You Need to Know

If you’ve scrolled this far, chances are you found this post while searching for something like “no loss Deriv bot free download”. You’re not alone — it’s one of the most popular phrases new traders type into Google.

But here’s the truth:

Most no loss Deriv bots are either outright scams, martingale time bombs, or completely fake

I’ve tested dozens of these so-called “no loss” bots over the years, and the pattern is always the same:

- ✅ They win for a few trades…

- ❌ Then blow your account when the market shifts

- 🔗 You’re pushed to deposit via shady affiliate links

- 🤖 The logic is hidden, flawed, or full martingale

If you’re serious about trading bots, don’t fall for the “no loss” dream.

Focus on logic you can test, risk you can manage, and results that actually hold up.

👇 More questions answered below:

FAQs On No Loss Deriv Bots

No. No system is immune to losses. But with PLS or smart setups, you can recover most sessions safely.

Not really. It recovers fast but fails fast too. PLS is more durable if used correctly.

It depends on your scaling plan and account size — but most of our setups can absorb 5–8 small losses without wiping out.

Try Zuno (Under 9) or Varus (Under 5) with low stakes and daily stop targets.

Use tick history in demo, journal 10–20 sessions, and test during different market hours.

PLS (Progressive Loss Scaling) is the safest method because it increases stake gradually, reducing risk during losing streaks. Unlike Martingale, it doesn’t double aggressively — making it more sustainable for small to medium accounts.

No bot is truly “no loss” — not even the most advanced. Many bots advertised with this phrase use martingale or fake backtests to trick new traders. If you’re serious, you need to test strategies with real data and realistic risk management. I explain how in this guide.

They can be — but it depends entirely on the logic behind the bot, how it manages risk, and the market conditions you’re using it in. Most “plug-and-play” bots sold online are either martingale-based or built with unrealistic assumptions. To see real results, you need a bot that’s been tested thoroughly, follows clear entry and exit logic, and respects stop loss and take profit levels. Even then, profits aren’t guaranteed — a good bot will have losing trades too. The goal isn’t perfection, it’s consistency over time.

💼 Recommended Brokers to Explore

Other Posts You May Be Interested In

XM Copy Trading Review 2024: Profit From Other Traders! ♻

📅 Last updated: December 6, 2023 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Taylor [...]

How to Verify Your Deriv Account (ID, Address & Common Problems Explained) ✅

📅 Last updated: July 24, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Taylor [...]

Deriv Account Types Review (2025): Which MT5 Account is Best For You? 🚀

📅 Last updated: June 18, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Taylor [...]

How To Open A Deriv Real Synthetic Indices Account in 2026 ☑️

📅 Last updated: February 16, 2026 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Taylor [...]

V75 Index Scalping Strategy: A Complete Guide for Quick Profits (2025) 💰

📅 Last updated: March 10, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Taylor [...]

⏱️ When to Trade Each Volatility Index on Deriv — Data-Driven Session Map

📅 Last updated: June 13, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Taylor [...]