If you’re looking for a Deriv under 5 bot that thrives on low-digit strength and doesn’t rely on aggressive doubling, Varus is your ideal match!

Varus is a Digit Under bot — meaning it wins when the last digit is 0 to 4 — and it’s designed to trade only when the chart is showing clear low-digit dominance. Unlike Martingale bots, Varus uses a PLS recovery system that’s far more forgiving for small accounts.

As someone who’s blown a few small accounts over the years by jumping into trades without reading the histogram, this one feels like a safe return to logic.

And just like all the other bots on the platform — Varus is completely free. No subscription, no limits, no catch.

Read Review

OPEN AN ACCOUNT

Read Review

OPEN AN ACCOUNT

Min Deposit: USD 1

Total Pairs: 100+

Regulators: MFSA, LFSA, VFSC, BVIFSC

🎯 Overall Strategy

Varus is a Digit Under 5 bot:

- Wins when the last digit is 0, 1, 2, 3, or 4

- Loses when the digit is 5, 6, 7, 8, or 9

The strategy is built around entering trades only when the digit chart shows a clear bias toward low digits. If digits 0–4 are dominant and digits 5–9 are weak — that’s when the bot shines.

🛠 How Varus Deriv Under 5 Bot Works

1️⃣ Entry Conditions

- Monitor the digit histogram

- Run the bot when digits 0–4 have high percentages, and digits 5–9 are suppressed

- Ideal setup: 3 or more high bars among 0–4, and 5–9 at low or zero%

2️⃣ Modes of Operation

The bot has 4 modes of operation

- scalper

- counter 1

- counter 2

- L virtual

These are explained in detail below under the configuration settings.

3️⃣ Trade Cycle

- In Scalper mode, you click play → one trade → pause

- In Counter mode, the bot waits for 1 or 2 bad digits before trading

- If a loss occurs, Varus begins PLS recovery:

- Increases stake gradually

- Safer than Martingale — less likely to blow up a small account

- After recovery, the bot pauses automatically (or you should manually stop and reassess)

🛡 Risk and Recovery System Of The Deriv Under 5 Bot

✅ PLS Recovery (Progressive Level Staking)

- Stake increases smoothly after a loss

- Doesn’t double aggressively

- Much better suited for accounts under $500

⚠ Loss Handling

- Bot continues trading through a loss cycle using PLS

- If recovery trade succeeds → profit is restored

- User is advised to pause and wait before continuing

🔌 How to Connect Your Deriv Account (Required)

To use the Varus bot (or any other bot on this platform), you must first connect your Deriv account to our exclusive trading platform. Don’t worry — we’ve created a simple guide with everything you need:

📘 What’s Inside the Setup Guide:

✅ Step-by-step connection instructions with screenshots

✅ Why the bots trade Synthetic Indices only

✅ Risk management principles every trader should follow

✅ How tick settings affect signal quality

✅ Why demo journaling matters before going live

👉 Follow the full guide here:

How to Connect Your Deriv Account to the Bot Platform

Once connected, you’ll be ready to explore Varus and the other bots with confidence.

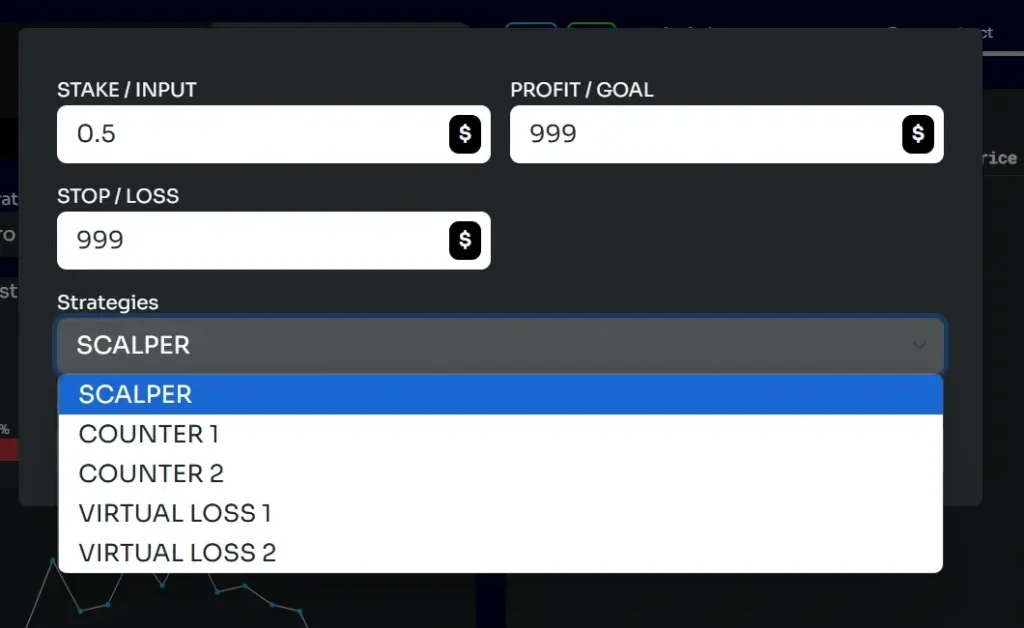

⚙ Varus Deriv Under 5 Bot Configuration Options

| Field | What It Controls |

|---|---|

| Stake / Input | The amount to stake per trade (e.g., $0.35 to $1 depending on account size) |

| Profit / Goal | Your daily profit target — bot stops when this is reached |

| Stop /Loss | The bot will stop if losses get to this figure |

⚙️ Strategy Modes Explained – Find What Works for You

One of the things I love about the Varus bot is the flexibility it gives you. You don’t just press “Run” and hope for the best — you can actually choose how trades are triggered based on your preferred level of risk and control.

Here’s what each mode does — and how you can experiment with them:

- Scalper Mode → Makes one trade and pauses after a win.

Perfect if you want fast hits and quick exits. Run it when the digit chart looks perfect and you just want a clean, simple entry. - Counter 1 Mode → Waits for 1 losing digit (5–9) before entering an Under 5 trade.

This is my personal favorite — it balances risk and opportunity. It doesn’t jump in too quickly, but still keeps the action going. - Counter 2 Mode → Waits for 2 losing digits (5–9) before entering.

Great if you’re ultra-cautious or trading in less predictable markets. It adds a strong filter to protect your account. - Virtual Loss 1 → Simulates 1 demo loss before entering live.

Ideal for those who want to test the waters before putting in real money. A smart layer of safety. - Virtual Loss 2 → Simulates 2 demo losses before going live.

Best for high-risk times or new users who want extra protection while learning the bot.

👉 My advice? Don’t just pick a mode and stick with it blindly. Run extensive demo tests using different modes, see how each one reacts in different market conditions, and log your results. Over a few days, you’ll get a clear feel for which mode fits your trading style, time availability, and risk appetite.

You’re not just running a bot — you’re building your own safe system.

💰 Recommended Settings by Account Size

Note: PLS is safer than Martingale — but it’s still critical to set reasonable stakes and not force recoveries.

If you’re curious about how PLS compares to Martingale and why we avoid calling any bot “no loss,” check out our deep-dive post:

👉 No Loss Deriv Bots – Myth or RealityIt breaks down recovery systems, common trader mistakes, and how to think long-term with bot strategies.

💰 If You Have a $100 Account

- Stake: $0.35

- Mode: Counter 1 or L Virtual

- Goal: $1 – $2

- Loss Limit: $5 – $10

💵 For those with a $500 Account

- Stake: $0.50 – $1.00

- Mode: Counter 2 or L Virtual

- Goal: $5 – $10

- Loss Limit: $25 – $50

🤑 Running a $1,000 – $10,000 Account? Proceed with Caution

Don’t let a bigger balance trick you into feeling untouchable — I’ve been there, and I’ve been burnt.

Here’s what I wish someone had drilled into me earlier:

- Stick to a daily target of just 1–2%

- Set a clear stop loss — no more than 10%

- Avoid Scalper mode unless the histogram is ultra-clean

- If you use Scalper, keep stake size small to allow recovery

One painful mistake I made? I saw a clean chart, got overconfident, went big with Scalper mode… and blew the trade. That loss stung — but it taught me to respect the bot and the market.

✅ Remember: The goal is slow, steady growth — not to flip your account in a day. This is a marathon, not a sprint.

👀 Bot Behavior Summary

- You control entry based on digit chart

- Ideal conditions = digits 0–4 strong, 5–9 weak

- Bot trades once per cycle

- If loss occurs, Varus recovers using PLS

- After recovery: pause, reassess, and wait for the next clean setup

🚩 Weaknesses

- While safer than Martingale, PLS can still draw down in long bad cycles

- Requires you to manually read the histogram

- Not hands-off — you need to pause during unstable periods

- Don’t expect daily profit if the chart isn’t giving you clean setups

🌐 Why Varus Trades Synthetic Indices

- Synthetic Indices run 24/7 — no downtime, no holidays

- Varus is designed for Volatility 100 (1s), which uses 1-second ticks

- Digit distribution is algorithm-driven — perfect for histogram-based entries

👉 New to synthetic indices? Read our full guide

📊 Risk Management Reminder

- ✅ Set a goal and stop-loss before you start

- ✅ Pause after recovery — don’t keep forcing trades

- ✅ Keep a demo log and journal your results

- ✅ Don’t increase your stake after wins — that’s how overconfidence ruins weeks of progress

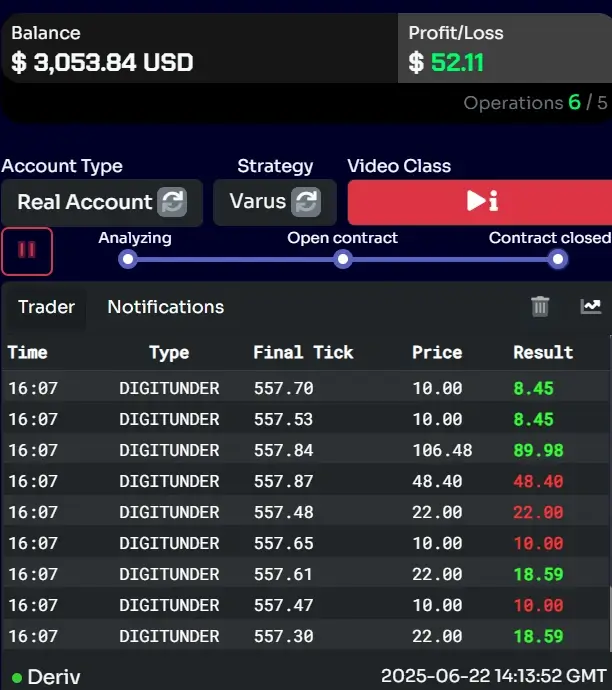

📈 Real Results: Varus Bot in Action

Here’s a live screenshot from one of my recent sessions using the Varus bot on a real Deriv account.

In this run:

✅ The bot reached the profit target of $52.11. My initial target was $50, but it was exceeded slightly due to recovery stakes.

⏱ In under 30 seconds — you can see all trades happened at 16:07 GMT

🎯 The bot entered with calculated stake adjustments using PLS recovery, managing losses and bouncing back quickly.

“This is why I always say — if you follow the histogram and use a sensible stake size, Varus will do its job. But never forget: trade conditions must be right, and you need to pause once the goal is hit.”

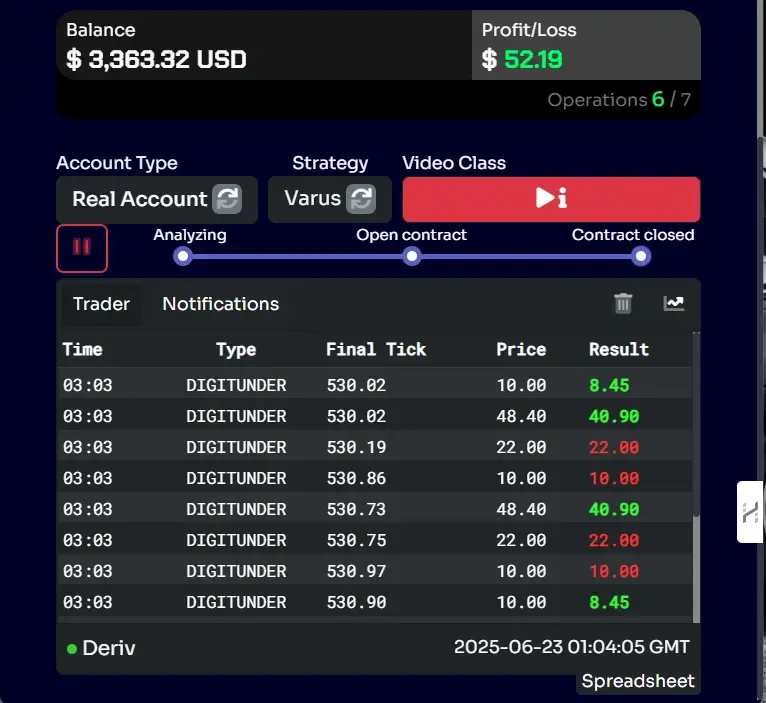

📊 Second Run Recap — Still Profitable Despite More Losses

In this round, Varus had 6 wins and 7 losses — yet still closed with a profit of $52.19.

Here’s why this is important:

💡 PLS recovery once again saved the session. Even with a win rate below 50%, the bot adjusted stake sizes smartly and used high-reward trades to pull the account back into profit.

⏱ Just like the earlier session, the target was hit in under a minute — showing how fast the bot works when conditions are favorable.

🔍 Key takeaway: You don’t need a perfect win rate for Varus to work — you just need:

- Smart stake sizing (PLS)

- A clean histogram (avoid running when digits 5–9 spike)

- The discipline to pause once the target is reached.

✅ It’s this consistency — despite losing more trades than it won — that proves Varus can be a solid performer if you manage it right.

🚀 Ready to Test Varus Yourself?

You’ve seen the results — even with 7 losses and just 6 wins, Varus still hit the target using smart PLS recovery.

🎯 You don’t have to take my word for it — you can start demo testing it right now.

⏱ It takes less than 5 minutes to connect your Deriv account and begin running Varus on demo.

👉 Click here to access the bot platform:

https://swagforex.trk.pro/

Start slow, observe how it reacts to the histogram, and get a feel for how recovery works. The real insights come from your own screen.

⭐ Final Verdict on Varus Deriv Under 5 Bot

Varus is one of the safest and most stable DigitUnder bots on the Deriv platform — especially for small account traders who want recovery without aggression.

If you’re disciplined, patient, and ready to let the chart guide your entries — this bot can become your go-to for consistent binary profits.

🚀 Explore Our Other Free Deriv Bots

Looking to try a different strategy? Each of our bots has a unique entry style and recovery system. Test them in demo mode and see which one fits your rhythm best.

🔻 Zuno – Under 9 Bot

Win when the last digit is 0–8. Switches to Under 5 mode after a 9-loss streak. Prioritizes account protection.

⏱ Win rate: ~90% when timed well.

⚙ PLS Recovery

⚖️ Oryx – Even Digit Bot

Wins on 0, 2, 4, 6, 8. Great for histogram-based parity trades. Balanced with a PLS recovery system.

🧠 Ideal for weekend traders and low-frequency entry setups.

⚙ PLS Recovery

📈 Axon – Over 2 Bot

Wins on digits 3–9. Higher win probability (~70%), with smaller payouts. Great for frequent small wins.

📊 Best for low-stress steady gains.

⚙ PLS Recovery

📊 Kiro – Over 4 Bot

Fires when digits 5–9 are dominant. Uses traditional Martingale recovery. Requires discipline and a watchful eye.

🔥 Win rate: ~66% but powerful when used with proper entry discipline

⚙ Martingale Recovery

👉 All bots are free to use. Just connect your Deriv account and trade responsibly!

Frequently Asked Questions (FAQs) on Deriv Under 5 Bot

A Deriv Under 5 bot is a trading algorithm that places Digit Under contracts — meaning it wins when the last digit is 0 to 4. The Varus bot is a good example, optimized to run when low digits dominate the histogram.

It can be — if used correctly. Bots like Varus use PLS recovery to minimize drawdown and enter trades only when digits 0–4 are dominant. The key is proper timing, discipline, and using small stakes.

Under 5 bots typically offer higher payouts but slightly lower win probabilities compared to Under 9 bots. They’re ideal for traders looking for stronger profit per win, provided the timing is right.

Yes — especially if the bot uses PLS recovery like Varus. Start with low stakes (e.g., $0.35) and avoid overtrading. It’s beginner-friendly if you stick to prophttps://synthetics.info/get/instaforex-bonuser management and wait for good entry setups.

💼 Recommended Brokers to Explore

Other Posts You May Be Interested In

Best Tips For Trading Synthetic Indices & Strategies (2025 Updated Guide)💰

📅 Last updated: June 13, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Taylor [...]

AvaTrade Account Types Review 2024: 🔍 Which One Is Best?

📅 Last updated: December 8, 2023 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Taylor [...]

What Is Deriv P2P (DP2P)? How to Fund & Withdraw Safely (Full Guide 2025)💳

📅 Last updated: June 12, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Taylor [...]

HFM Broker Review (Hotforex)2024: 🔍Is It Reliable?

📅 Last updated: January 3, 2024 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Taylor [...]

Varus – Deriv Under 5 Bot with Safe PLS Recovery Strategy (2025)🤖

📅 Last updated: June 23, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Taylor [...]

Best Deriv Bot for Small Account: What Actually Works Without Blowing Your Balance

📅 Last updated: June 23, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Taylor [...]