If you’re searching for a free Deriv bot, you’ve probably seen big claims:

- “No loss bot”

- “100% win rate”

- “Double your account daily”

- “Fully automated passive income”

Let’s reset expectations.

There are no no-loss binary bots — only structured recovery systems with managed exposure..

There are structured bots with controlled recovery logic.

And that difference matters.

In this guide, I’ll break down the 5 best free Deriv binary bots for synthetic indices — what they do well, where they struggle, and who they are actually suitable for.

These bots are:

- Free to use (no downloads needed)

- Built for synthetic indices

- Tested in live sessions

- Based on PLS (Progressive Loss Scaling), not blind Martingale

But they still require discipline.

Before You Use Any Free Deriv Bot

Let’s be clear:

- These bots do lose.

- They rely on structured recovery.

- They are not passive income machines.

- They require stop targets and stake discipline.

PLS (Progressive Loss Scaling) is safer than aggressive Martingale doubling — but it still increases exposure after losses. That means your survival depends on:

- Starting stake

- Account size

- Stop discipline

- Market digit distribution

If you’re chasing a “no loss Deriv bot free download”, this page won’t sell you a fantasy.

It will show you structure.

Read Review

OPEN AN ACCOUNT

Read Review

OPEN AN ACCOUNT

Min Deposit: USD 1

Total Pairs: 100+

Regulators: MFSA, LFSA, VFSC, BVIFSC

🟢 Zuno Bot (Under 9 with Recovery Fallback)

How it works:

Zuno enters when digit 9 % is low. If it loses on digit 9 — which can be a trap — it switches to an Under 5 fallback until the loss is recovered. This gives it more flexibility and reduces risk.

It’s designed for:

- Controlled sessions

- Balanced digit environments

- Small accounts with discipline

Why Zuno is a Deriv Bot Suitable for Small Accounts

- Starts from low stake levels ($0.35)

- Uses less aggressive progression

- Designed to recover gradually

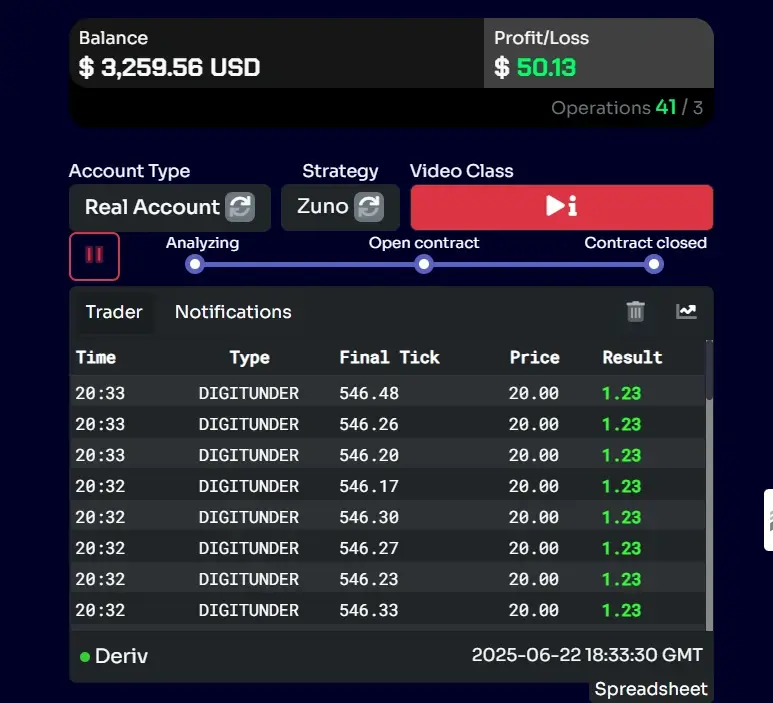

🖼 Real Session Example

In a short controlled session:

44 trades, 41 wins, 3 losses.

Recovery held well and target was reached quickly.

But context matters.

This type of performance depends on digit rotation staying within statistical norms. Prolonged digit clustering can stretch recovery cycles.

Where Zuno Struggles

- Extended same-digit dominance

- High volatility tick acceleration

- Users increasing base stake too early

- Ignoring session stop targets

Zuno is not a no-loss system.

It is a structured Under strategy with moderated recovery logic.

👉 Interested in learning more about how Zuno works?

Check out the free, step-by-step guide that covers:

- ✅ Best configurations for small and big accounts

- ✅ Smart risk management tips

- ✅ Full setup and connection walkthrough

- ✅ When to use Zuno and why it works

- ✅ Common mistakes to avoid when running it

🟢 Varus Bot (Pure Under 5 Strategy)

How it works:

Varus trades Under 5 digits and recovers slowly using PLS. It waits for high digits (5–9) to dominate before jumping in, giving it strong win probability when used correctly.

Why It’s Good for Beginners

- Simple logic

- Clear structure

- Handles 4–6 small losses reasonably

- Works well on demo for learning digit behaviour

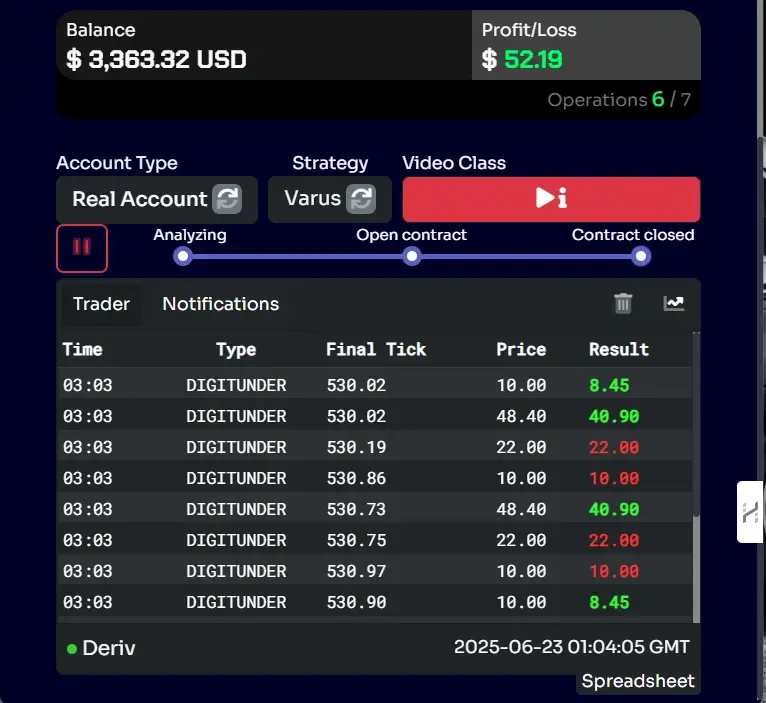

Sample Session

🖼 13 trades, 6 wins, 7 losses — recovery held and target was reached relatively fast.

That’s the key: structured recovery, not perfect accuracy.

Where Varus Breaks Down

- Over-leveraged small accounts

- Users removing caps on recovery

- Sessions during extreme digit skew

- Emotional manual overrides

Varus is safest when paired with:

- Fixed session targets

- Strict loss caps

- Moderate account size

👉 Want to understand how the Varus bot really works?

This free guide breaks down everything you need to know, including:

- 🔹 Recommended stake sizes and recovery steps

- 🔹 Tips for managing risk on low balances

- 🔹 How to set up and run Varus in under 5 minutes

- 🔹 When Varus performs best — and when to pause

- 🔹 Red flags to watch out for during tricky sessions

🔵 Axon Bot (Over 2 with Smart Entry)

How it works:

Axon looks for dips in digits 0–2 and enters when they’re weak. It runs Over 2 with recovery steps designed to work on both stable and slightly volatile conditions.

Why it’s a good step-up bot:

- Works well on $30+ accounts

- Strong session win potential

- Designed for slightly volatile conditions

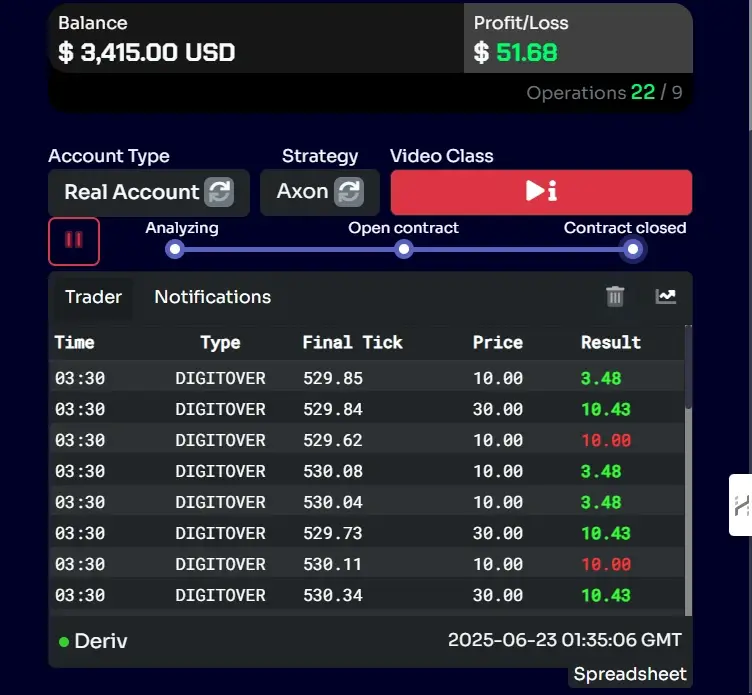

🖼 Real Session Snapshot: $51.68 profit in 5 minutes — 31 trades, 22 Wins, 9 losses with steady recovery

Again, this works best in balanced environments.

Where Axon Fails

- Prolonged low-digit suppression

- Small accounts using large base stake

- Trading during erratic volatility shifts

Axon requires more discipline than Zuno or Varus.

👉 Thinking about trying the Axon bot?

Before you jump in, take a few minutes to go through the full breakdown. It covers:

- 🟦 Ideal stake levels for different account sizes

- 🟦 How Axon reads digit weakness for smart Over 2 entries

- 🟦 Full setup and connection process made simple

- 🟦 When Axon shines — and when to sit out

- 🟦 Key recovery logic explained with real-session examples

🔵 Kiro Bot (Over 4 for Fast Climbs)

How it works:

Kiro enters when digits 0–4 are quiet, aiming for Over 4 wins (5–9). It’s slightly more aggressive and works best when paired with a decent account buffer and proper entry filters.

Best For:

- $50–$100+ accounts

- Traders comfortable with higher exposure

- Structured but confident setups

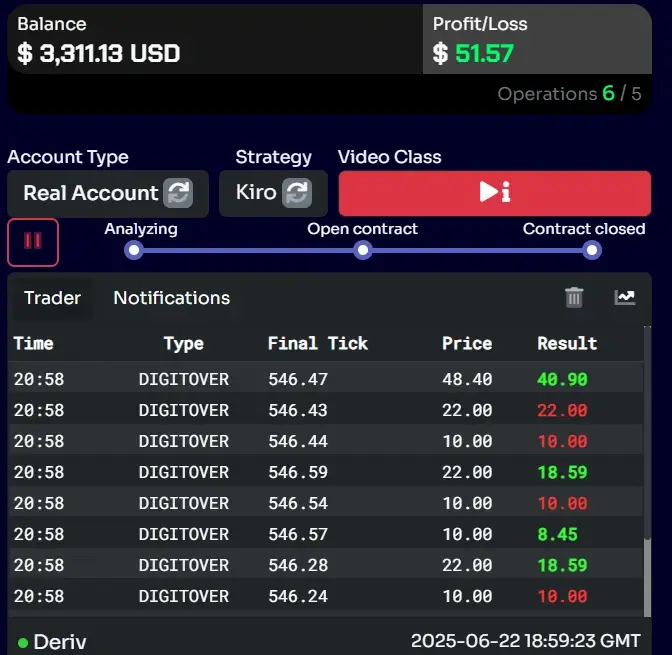

🖼 Session example: clean PLS recovery with tight setups. 11 trades, 6 wins, 5 losses. Three-minute operation.

Where Kiro Can Be Dangerous

- Extended 0–4 dominance

- Users chasing after early losses

- Removing progression caps

- Trading without session targets

Kiro is powerful when controlled.

It is risky when emotional.

👉 Curious about how the Kiro bot handles Over 4 entries?

This free guide walks you through everything, including:

- 🔸 How to configure Kiro for safe recovery

- 🔸 The logic behind its Over 4 entries and when to activate it

- 🔸 Full connection and setup instructions

- 🔸 Best market conditions for Kiro to perform well

- 🔸 Common slip-ups to avoid when using this bot

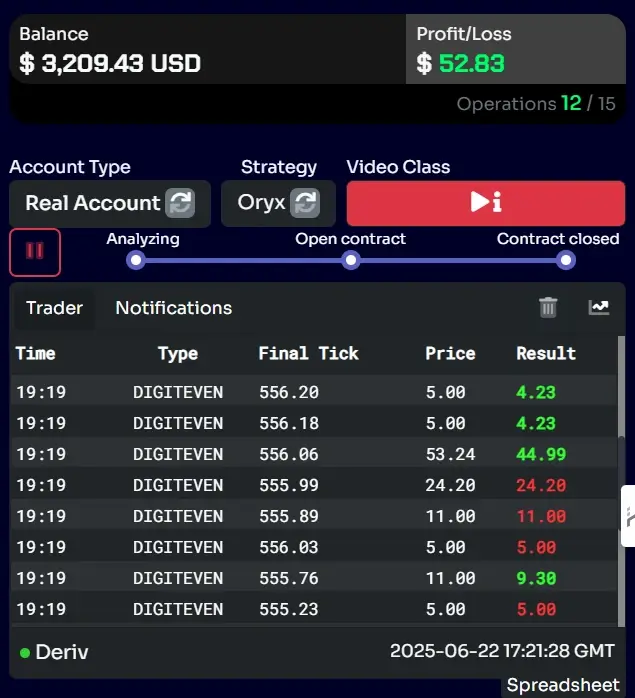

🟡 Oryx Bot (Even Digit Parity Strategy)

How it works:

Oryx targets even digits (0, 2, 4, 6, 8) and avoids odds. It uses parity histogram logic to enter when the market leans heavily toward one side. Surprisingly powerful when digit distribution is skewed.

Why It’s Unique

- Different logic structure

- Works during imbalance phases

- Can recover steadily with controlled progression

🖼 In one session: 27 trades, 12 wins, 15 losses — still hit $52.83 profit in under 5 minutes thanks to structured recovery logic.

This shows something important:

Win rate alone doesn’t define performance.

Recovery structure does.

Where Oryx Struggles

- Balanced digit rotation

- Flat distribution sessions

- Improper stake scaling

Oryx is best used by traders who understand digit cycles.

👉 Interested in how the Oryx bot trades even digits profitably?

This in-depth guide gives you a complete walkthrough, including:

- ⚪ How the bot detects even/odd imbalance

- ⚪ Suggested stake sizes and realistic targets

- ⚪ Step-by-step setup and connection instructions

- ⚪ When to run Oryx — and when to hold back

- ⚪ What to watch for during volatile parity swings

Who These Bots Are Not For

These bots are not ideal if:

- You’re trading undercapitalized accounts with oversized base stakes

- You remove progression caps

- You expect fully passive profit

- You chase losses after session targets are hit

Automation removes emotion — it does not remove probability.

These bots can blow small accounts if misused.

📥 Want to Try These Best Deriv Binary Options Bots?

You’ll need a connected Deriv account first. We’ve made a full guide with:

- Screenshots

- Risk tips

- Tick level setup

- Journaling advice

- Recovery configuration

👉 Start here: Connect your Deriv account and get started

Then you can access the full free platform:

👉 Run all 5 bots now (Free Platform)

- Switch between demo and real

- Pre-loaded with all five bots

- Safe recovery logic built in

⚖️ Real Talk About Safety

Let’s be clear.

These bots are structured — but they are not risk-free.

They will lose trades. They can hit recovery cycles. And in abnormal digit behavior, progression can stretch longer than expected.

What matters isn’t just how they recover — it’s how you manage exposure.

All the bots listed here use PLS (Progressive Loss Scaling), not aggressive Martingale doubling. That reduces the speed of stake escalation — but it does not eliminate drawdown risk.

Recovery logic improves survivability when paired with:

- Sensible base stake

- Hard session stop-loss

- Realistic session targets

- Discipline to stop once target is hit

If you’re specifically looking for a “no-loss Deriv bot”, understand this:

Loss elimination is not mathematically sustainable in binary digit trading.

If you want the full breakdown on that, read this:

👉 The truth about no-loss Deriv bots and how real recovery works

Bottom line:

- Control your stake.

- Test on demo extensively.

- Cap progression.

- Journal sessions.

The bot executes logic — you manage risk.

⭐ Why These Are Among the Best Free Deriv Binary Bots for Synthetic Indices (2026)

There are hundreds of free bots online — many recycled, many overhyped.

So why are these different?

Because they are structured, transparent, and built specifically for synthetic digit trading.

Here’s what sets them apart:

✅ Structured entry logic

Each bot follows defined digit-based rules. No random triggers. No blind signal copying. Entries are based on measurable digit behavior — not hype screenshots.

✅ Moderated recovery (PLS, not blind doubling)

These bots don’t use aggressive exponential Martingale jumps. Instead, recovery scales progressively. That reduces account shock — but still requires strict exposure control.

✅ Real session transparency

The examples shown include wins and losses. Performance depends on digit distribution, not magic accuracy. Short sessions can perform well — extended skewed cycles require discipline.

✅ No paywalls or shady downloads

You don’t buy anything. You connect your Deriv account and test on demo first. That keeps risk in your hands.

✅ Built for synthetic indices specifically

These aren’t generic forex EAs. They’re optimized for tick-based digit contracts where automation genuinely has an execution advantage over manual trading.

✅ Different profiles for different risk tolerance

Some bots are conservative. Some are faster and more aggressive. Choosing the right one depends on your account size and recovery comfort level — not on which one “wins fastest.”

These aren’t miracle bots.

They’re structured automation tools.

Used properly, they can improve consistency.

Used carelessly, they can accelerate drawdown.

💬 What’s Your Favorite Bot So Far?

Have you tried any of these? Got results to share or tips for new traders?

👇 Drop a comment below. Let’s build a better community — one safe trade at a time.

FAQs Best Free Deriv Binary Bots for Synthetic Indices 2026

Zuno, Varus, and Axon are among the best free Deriv bots for synthetic indices. They use smart entry logic and safer recovery methods like PLS, making them ideal for both beginners and small accounts.

es. All bots listed here are free, safe to test on demo, and don’t require payment to access. Each has been tested in real sessions and comes with a full setup guide.

The best bots for synthetic indices are fast, consistent, and able to handle tick volatility. All five bots here are built for speed, smart recovery, and digit-based logic.

Yes, Deriv officially supports trading bots. Their platform includes tools like DBot, and they allow API-based automation on synthetic indices. As long as the bot doesn’t violate platform rules (like overloading servers or exploiting errors), it’s fully permitted to use recovery bots, digit bots, and other automated strategies.

You can access free Deriv trading bots by connecting your account to a safe bot platform like the one linked in this guide. All five bots — including Zuno, Varus, and Axon — are free to use, pre-configured, and work on both demo and real accounts. No payments, no complicated setup — just follow the step-by-step guide to get started.

💼 Recommended Brokers to Explore

Other Posts You May Be Interested In

Flix1 Synthetic Index Price & Trading Guide on Deriv 2025 💹

📅 Last updated: June 5, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Taylor [...]

Exness Review 2024: 🔍 Is This Forex Broker Legit & Reliable?

📅 Last updated: December 12, 2023 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Taylor [...]

V75 Index Scalping Strategy: A Complete Guide for Quick Profits (2025) 💰

📅 Last updated: March 10, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Taylor [...]

HFM Copy Trading Review: ♻ Copy Top Traders Today!

📅 Last updated: November 24, 2023 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Taylor [...]

⚡Top 5 Most Volatile Synthetic Indices on Deriv & How To Trade Them In 2025

📅 Last updated: May 25, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Taylor [...]

How To Use Deriv Payment Agents (Full Guide 2025) — Deposit, Withdraw, Agent List, CR Number, Become an Agent💰

📅 Last updated: June 21, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Taylor [...]