When I first started trading on Deriv back in 2016, moving money in and out of my account was a real challenge.

Bank cards didn’t always work. E-wallet fees were too high. And if you wanted to trade on weekends or late at night, good luck finding a reliable method.

This is exactly why I jumped at the opportunity to become a Deriv Payment Agent when the feature was introduced. I knew a lot of traders were facing the same issue — and there was a big market to service clients.

I’ve been a Deriv Payment Agent since 2021, and over the years I’ve helped hundreds of traders across Africa deposit and withdraw using local payment methods like mobile money, bank transfers, and even cash.

In my view, one of the biggest reasons Deriv has become so popular across Africa is because of this Payment Agent system.

It has made the platform accessible to traders who:

✅ don’t have working bank cards

✅ trade at odd hours

✅ simply want a fast, local way to move funds — even on weekends.

I’ve personally helped traders withdraw funds on a Saturday evening so they could enjoy their night out — that’s the flexibility this system offers.

In this updated 2025 guide, I’ll show you:

- How to deposit and withdraw using Payment Agents

- How to find the Deriv payment agent list

- How to become a Payment Agent

- What is the CR number and how to use it

- Real tips to avoid common mistakes

- Answers to key questions traders ask every day

Read Review

OPEN AN ACCOUNT

Read Review

OPEN AN ACCOUNT

Min Deposit: USD 1

Total Pairs: 100+

Regulators: MFSA, LFSA, VFSC, BVIFSC

🤝 What Are Deriv Payment Agents?

A Deriv Payment Agent is an independent person or business approved by Deriv to help traders deposit and withdraw funds using local payment methods that are not supported directly on the platform.

They process payments via:

- Bank transfers

- Cash

- Mobile money (Mpesa, EcoCash, Momo Money, Airtel Money, etc.)

Agents don’t work for Deriv — they’re verified partners who charge a small commission per transaction.

👉 Why use Deriv Payment Agents?

- Faster than card withdrawals or bank wires

- More flexible — supports mobile money and cash

- Works when cards or e-wallets fail

- Ideal for traders in Africa, LATAM, parts of Asia

You need a real Deriv account to use payment agents.

➡️ Get step-by-step instructions with screenshots on how to open an account here.

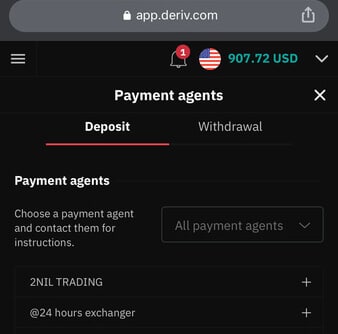

📋 How To Find the Deriv Payment Agent List

One of the top questions I get is: “Where can I find the official Deriv Payment Agent list?”

Here’s how:

1️⃣ Log into your Deriv account

2️⃣ Go to Cashier

3️⃣ Select Payment Agents (you’ll see it under Deposit or Withdraw options)

4️⃣ Browse the list — you can filter by:

- Country

- Payment method

- Transaction limits

✅ Tip: Always contact the agent first to confirm availability before submitting a request.

💰 How To Deposit Into Deriv Using a Payment Agent (Step-by-Step)

Depositing through a Payment Agent is simple and works great in countries like Zimbabwe, Nigeria, Kenya, South Africa, Botswana, and many others.

Here’s how:

1️⃣ Log in to your Deriv account

2️⃣ Go to Cashier → Deposit → Payment Agents

3️⃣ Choose an agent from the list

4️⃣ Contact the agent (Whatsapp/Telegram) and confirm:

- Deposit amount

- Payment method (Mpesa, EcoCash, Bank, etc.)

- Fees or commission

5️⃣ Pay the agent and send proof of payment

6️⃣ Give them your CR number and full name (see below for CR number details)

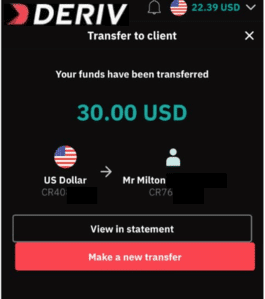

7️⃣ The agent processes your deposit — funds reflect instantly in your Deriv wallet. If needed, the payment agent can send you proof of transfer like the image below.

8️⃣ If needed, go to Cashier → Transfer to move funds to your Synthetic Indices or MT5 account

👉 Tip: Start small when using a new agent.

Real tip from experience:

Over the years, I’ve built a strong client base — and now most of my clients simply call me first to check if I have float. Once I confirm, they send Mobile Money and I process their deposit instantly.

They no longer have to search through the Deriv platform — because I’ve earned their trust through consistent, reliable service.

That’s the kind of relationship you want to build if you plan to become a serious Payment Agent.

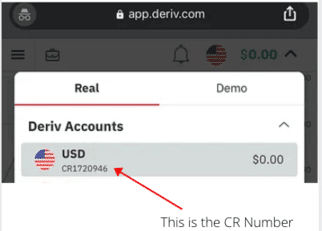

🔎 What Is CR Number In Deriv?

One of the most searched queries is “What is CR number in Deriv?”

Here’s the answer:

Your CR number (Client Reference number) is your unique Deriv account ID. It usually starts with CR followed by numbers.

✅ Agents use this number to make sure they deposit or withdraw funds to/from the correct account. When they enter it in the system it will display your Deriv account name for verification.

👉 You can find your CR number by logging into your Deriv dashboard — it’s displayed on your account profile.

✅ For agents — always double-check the CR number matches before processing any transaction.

You can see an example of a CR number in the image below.

💵 How To Withdraw From Deriv Using a Payment Agent (Step-by-Step)

Withdrawing through a Payment Agent is fast, flexible, and great for cash or mobile money withdrawals.

Here’s how:

1️⃣ Move funds to your main Deriv account → Cashier → Transfer

2️⃣ Go to Cashier → Withdraw → Payment Agents

3️⃣ Choose your agent and contact them to:

- Confirm commission

- Confirm payment method

- Ensure they are online and ready to process (important!)

4️⃣ Enter the agent’s CR number and name

5️⃣ Confirm the withdrawal — funds will be instantly transferred to the agent

6️⃣ The agent will then pay you via your agreed local method (Mpesa, EcoCash, Bank, Cash)

✅ Real Tip: Always confirm the agent is online. I once had a client withdraw when I was offline — they had to wait a full day.

✅ How To Become a Deriv Payment Agent (2025 Guide)

If you’re asking “How to become a Deriv Payment Agent?” or “how to be a Deriv agent”, here’s what you need:

Requirements:

- Fully verified Deriv account (see verification guide here)

- Minimum $2,000 USD account balance at the time of application

- Payment Agent name (avoid using “Deriv” in your name)

- Website and/or social media profiles (Facebook, Telegram, WhatsApp)

- Accepted payment methods (local bank, mobile money, cash)

- Commission structure (1%–9% max allowed)

- Methods for funding your agent account (PerfectMoney, AirTM, crypto, etc.)

How to apply:

Send an email with all details to: [email protected]

👉 Deriv will review your application and, if approved, add you to the official Payment Agent list. You can then start processing deposits and withdrawals on behalf of clients.

✅ Tip: Provide excellent service — clients will return and refer others.

🛡️ Tips To Use Payment Agents Safely

- Only deal with agents listed inside the official Deriv dashboard.

- Always confirm fees and commissions upfront.

- Double-check agent transaction limits.

- Provide accurate CR number and account name.

- Never share your Deriv password — no agent should ask for it.

- Keep all receipts and proofs of transactions.

- Test small amounts first with a new agent.

✅ Advantages of Using Deriv Payment Agents

Here’s why I still recommend Payment Agents — and why many of my clients continue to use them today:

✅ Fast local deposits and withdrawals

You can move money in and out of your account in minutes — especially with trusted agents.

✅ Flexible payment methods

Bank transfers, Mobile Money (FNB eWallet, Mpesa, EcoCash, Airtel Money, Momo Money), even cash — agents support what works locally.

✅ Works outside banking hours

I’ve processed deposits and withdrawals for clients on weekends and late nights — something most banks and e-wallets can’t do.

✅ Bypasses international card restrictions

If your country blocks forex payments via card, Payment Agents give you a safe alternative.

✅ Build trusted relationships

Over time, you can build a relationship with one or two reliable agents and avoid the hassle of searching the list every time. I have also even advanced clients funds and they pay later due to a good working relationship.

Not sure which local payment method works best in your country? I’ve covered this in detail here:

💳 Deriv Deposit & Withdrawal Methods by Country.

⚠️ Disadvantages of Using Deriv Payment Agents

That said — there are a few downsides to be aware of:

⚠️ Fees vary by agent

Agents can charge anywhere from 1% to 9%. You need to compare and negotiate.

⚠️ Risk of agent unavailability

If an agent goes offline, your transaction may be delayed — always confirm first.

⚠️ Quality varies

Not all agents offer the same level of service — some are fast and reliable, others are not.

⚠️ Small markets can see limited float

In smaller countries or during peak periods, some agents may run out of float (funds) and be unable to process large deposits/withdrawals immediately.

⚠️ You must trust the agent

While all listed agents are verified, the transaction still involves trust — so it’s critical to follow the safety tips I’ve shared above.

Bottom line:

👉 For most traders in Africa and emerging markets, Payment Agents remain one of the best tools — as long as you choose the right agent and stay smart.

👉 If you want even more flexibility, you can also explore Deriv Peer to Peer (DP2P) — I’ve written a full guide on how to use it safely.

FAQ’s On How To Deposit & Withdraw Using Deriv Payment Agents

Independent partners approved by Deriv to help traders deposit/withdraw using local payment methods.

Go to Cashier → Payment Agents and browse the official list.

Fees vary by agent and payment method — typically 1% to 9% max.

Yes — if you use agents listed on the official Deriv list and follow the safety tips above.

Contact Deriv’s customer support for assistance. They can provide guidance and help resolve any issues or queries you may have regarding payment agent transactions.

our unique Client Reference number — used by agents to process transactions to the correct account.

Go to Cashier → Withdraw → Payment Agents, select your agent, confirm terms, and process the withdrawal.

Read Review

OPEN AN ACCOUNT

Read Review

OPEN AN ACCOUNT

Min Deposit: USD 1

Total Pairs: 100+

Regulators: MFSA, LFSA, VFSC, BVIFSC

💼 Recommended Brokers to Explore

Other Posts You May Be Interested In

Range Break Indices

📅 Last updated: May 22, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Taylor [...]

How to Verify Your Deriv Account (ID, Address & Common Problems Explained) ✅

📅 Last updated: July 24, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Taylor [...]

How to Trade Deriv Drift Switch Indices (DSI 10, 20, 30 Explained)

📅 Last updated: July 3, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Taylor [...]

Best Tips For Trading Synthetic Indices & Strategies (2025 Updated Guide)💰

📅 Last updated: June 13, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Taylor [...]

Varus – Deriv Under 5 Bot with Safe PLS Recovery Strategy (2025)🤖

📅 Last updated: June 23, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Taylor [...]

XM Account Types Review (2024) ☑ Choose The Right One ⚡

📅 Last updated: December 6, 2023 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Taylor [...]