👉 Don’t have a Deriv account yet? Click here to open yours now and start using DP2P →

When I first started using Deriv back in 2016, Deriv P2P didn’t even exist.

If you wanted to fund your trading account, you had to go through Skrill, Neteller, or hunt for local Payment Agents. And if those failed, well — you were stuck.

That all changed when Deriv launched DP2P — their own built-in peer-to-peer deposit and withdrawal system.

Today, DP2P is by far one of the easiest ways to move money in and out of your Deriv account, especially if you’re in a country where bank cards don’t always work smoothly.

In this guide, I’ll walk you through exactly how I fund and withdraw from my account using DP2P, how to stay safe, and some pro tips that will save you headaches.

What Is DP2P (Deriv P2P)?

DP2P in Deriv stands for Deriv Peer-to-Peer.

It’s a secure feature inside your Deriv account that allows you to buy or sell USD balances directly with other verified traders — using local payment methods such as:

- Mobile Money (Mpesa, Airtel Money, Momo Money)

- Bank Transfer

- Cash

- ZIPIT

- Mukuru

- and many others, depending on your country

You simply match with a seller inside DP2P, send payment via your preferred local method, and once they confirm receipt, Deriv releases the USD to your trading account instantly.

Why is this better than bank cards or e-wallets?

Many countries — especially across parts of Africa, Asia, and Latin America — face intermittent issues with international card processing or restrictions on funding forex/derivatives platforms.

But even in countries where bank cards do work, DP2P remains a great option because:

✅ It’s often faster (fund your account in minutes)

✅ In many cases, cheaper than card fees or currency conversion charges

✅ You can use local payment rails that are more convenient for day-to-day traders

✅ You bypass the pressure of verifying your e-wallet account. Once you are verified in Deriv you are good to go

Bottom line: DP2P gives you more flexibility, more control, and more speed — whether you’re in a market with payment challenges or just looking for a better alternative.

This system became even more important after Skrill and Neteller pulled out of several countries in 2021. That’s when a lot of traders started asking “how do I fund my Deriv account now?” or “can I transfer money from one Deriv account to another?”

Short answer: Not directly. But with DP2P, you can find someone to do the transfer for you — safely, and within Deriv’s rules.

Read Review

OPEN AN ACCOUNT

Read Review

OPEN AN ACCOUNT

Min Deposit: USD 1

Total Pairs: 100+

Regulators: MFSA, LFSA, VFSC, BVIFSC

How To Register & Set Up DP2P (Step-by-Step)

Before you can start using DP2P, there’s one requirement:

You must have a verified Deriv account.

This is to protect both you and other traders, since DP2P involves real-money transfers.

✅ If you don’t have a Deriv account yet, create one here.

✅ Make sure to register using the exact name on your ID or passport — this will be required for verification.

👉 Not sure how to complete your verification? Here’s a simple step-by-step guide on

➡️ How to Verify Your Deriv Account.

Once your account is verified (usually takes less than 48 hours), you’re ready to set up your DP2P profile.

1️⃣ Log In & Access DP2P

- Log into your Deriv account.

- Go to Cashier → DP2P tab.

If it’s your first time, you’ll see a quick setup screen.

2️⃣ Set Up Your DP2P Profile (First-Time Users)

You’ll be asked to:

- Choose a nickname → This will be visible to other traders.

- Upload identity documents → Passport or National ID (for extra security).

- Add your payment methods → e.g. Momo Money, ZIPIT, Bank Transfer, Mobile Money.

- Select your trading countries → Where you want to buy/sell from.

- Set your availability times → Let buyers/sellers know when you’re online.

👉 This only takes a few minutes — and trust me, it saves a lot of time later.

Once you complete this profile setup and your documents are approved, you’ll be ready to use DP2P.

Important tip:

✅ Don’t skip the profile setup — it helps you attract better trading partners and ensures smoother transactions.

How To Do Deriv DP2P Login

Once your DP2P profile is approved, logging in is simple — and there are two ways to do it:

✅ Login via Deriv Website

- Log in to your main Deriv account.

- Go to Cashier → DP2P tab.

This takes you straight into the DP2P marketplace where you can create Buy USD or Sell USD orders.

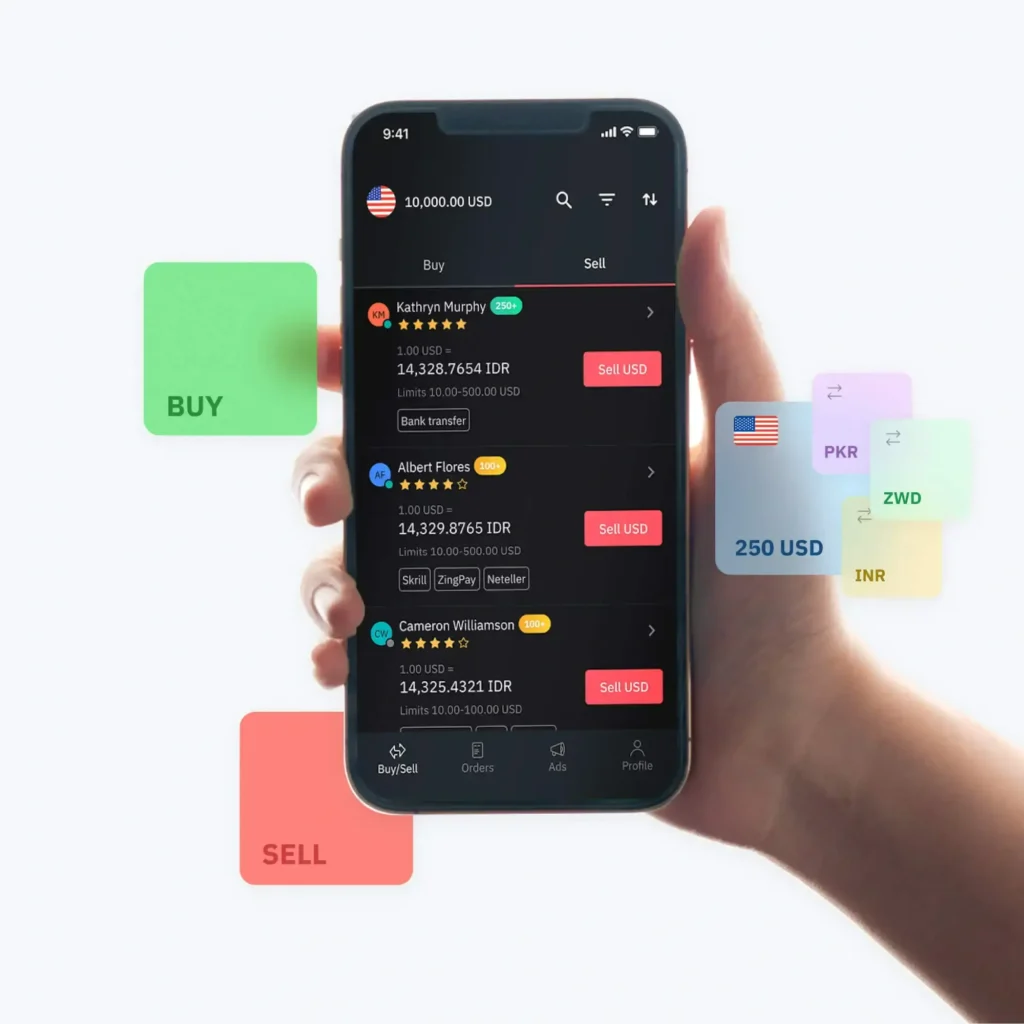

DP2P Download & Mobile Login

If you prefer trading on mobile, you can easily use the dedicated Deriv DP2P app — it’s available for both Android and iOS.

Here’s how to get started:

✅ Download the app:

✅ Log in:

- Use the same email and password as your main Deriv account.

- Once logged in, you’ll land inside the DP2P marketplace — ready to create Buy USD or Sell USD orders.

✅ Bonus tip:

- You can also access DP2P directly via the web browser by going to your Deriv account → Cashier → DP2P tab.

👉 The mobile app is especially useful if you want to manage trades on the go and get push notifications when orders are placed.

👉 The app is especially useful if you want to manage trades on the go and get push notifications.

How To Fund Your Deriv Account Using DP2P (Full Walkthrough)

Now that your DP2P profile is ready, let’s walk through exactly how to fund your Deriv account.

This process works whether you’re in Africa, Asia, LATAM, or any country where DP2P is available.

You don’t need an international card, an e-wallet, or a bank that supports forex brokers. All you need is:

✅ A verified Deriv account

✅ A local payment method — Mpesa, EcoCash, Bank Transfer, Mukuru, ZIPIT, Airtel Money, Momo Money, etc.

Here’s my tested flow — the same one I personally use every week:

Step 1️⃣ Log In to Deriv → Open DP2P

Head to your Deriv account → Cashier → DP2P tab.

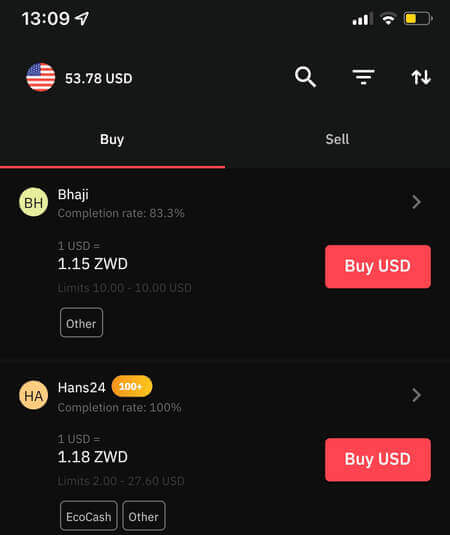

You’ll now see a list of verified sellers offering USD at different rates and with different payment options.

Step 2️⃣ Choose a Seller

When choosing a seller, look at:

- Exchange rate → Aim for a reasonable rate.

- Min/Max limits → Make sure the seller’s limits fit the amount you want to fund.

- Accepted payment methods → Use one that is fast and convenient for you.

- Seller rating → Choose sellers with a strong history (high completion rate, good reviews).

Pro tip:

✅ Always message the seller inside DP2P chat first to confirm they are online and ready before sending any money.

Step 3️⃣ Place Your Order

Once you’ve chosen a seller:

- Click “Buy USD”.

- Enter the amount you want to fund.

- Confirm the order — Deriv will now lock the seller’s funds in escrow while the payment is processed.

Step 4️⃣ Make Your Payment

- Send the money via the payment method agreed (Mobile Money, Bank Transfer, ZIPIT, Mukuru, etc.).

- Upload a screenshot or proof of payment inside DP2P.

- Only then click “I’ve Paid” → This notifies the seller that you’ve sent the funds.

Important:

✅ Never click “I’ve Paid” until you’ve actually sent the money and uploaded proof.

Step 5️⃣ Receive Your Funds

Once the seller confirms they’ve received your payment, Deriv will instantly release the USD into your Deriv account.

✅ You can now move those funds to your Synthetic Indices account, MT5, or any other Deriv wallet you want to trade from.

Key Reminders

- Keep all chats inside DP2P — never move to WhatsApp or Telegram.

- Always verify payment is complete before clicking “I’ve Paid.”

- If a seller delays or goes offline, cancel and choose a different one.

That’s it — 5 simple steps and your account is funded.

Once you do this once or twice, it becomes second nature.

DP2P is one of several ways to fund your Deriv account.

If you want to compare it to bank cards, Payment Agents, and other options, check out my full guide on:

💳 How to Deposit into Deriv Account

How To Withdraw From Deriv Using DP2P (Step-by-Step)

DP2P isn’t just for funding your account — it also works perfectly for withdrawing funds to your local currency.

If you’ve ever asked:

✅ How do I withdraw from Deriv without a bank card?

✅ Can I sell my USD balance to EcoCash / Bank / Mpesa?

The answer is yes — using DP2P.

This is actually the method I recommend to most traders, because it’s:

- Fast

- Flexible

- Protected by escrow

Here’s exactly how to do it:

Step 1️⃣ Open DP2P & Go to Sell USD

- Log into your Deriv account → Cashier → DP2P tab.

- If using mobile, open the DP2P app.

You can now either:

- Post a Sell Ad (My Ads → Post Ad)

OR - Choose an existing Buy USD offer from another trader (this is faster for small withdrawals).

Step 2️⃣ Set Up Your Selling Details (If Posting an Ad)

If you post your own ad, you’ll be asked to set:

- Amount of USD you want to sell.

- Exchange rate (check market rates first).

- Min/Max limits.

- Accepted payment method (EcoCash, ZIPIT, Mukuru, Bank Transfer, Mobile Money, etc.).

- Availability times.

👉 If you choose an existing Buy USD ad instead, you skip this part and move straight to placing your order.

Step 3️⃣ Chat With the Buyer Before Releasing Funds

Once someone places a Buy USD order from you:

✅ Message the buyer inside DP2P chat to confirm they are online and ready to pay.

✅ Verify what payment method they will use.

Important:

- Never release funds until the payment is fully reflected in your account.

- Don’t rely on screenshots alone — confirm with your bank app or mobile wallet.

Step 4️⃣ Receive Payment & Confirm

The buyer will send the payment to your account.

✅ Once you see the funds fully received → click “Release Funds” inside DP2P.

This completes the transaction and the buyer gets their USD.

✅ After the order is completed, take a moment to rate the buyer — it helps build trust and keeps the community strong.

Pro Tips For Withdrawing Smoothly

- Chat first — if the buyer doesn’t reply quickly, cancel the order.

- Double-check your payment method — make sure it matches what you selected in your profile.

- Always verify payment fully — not just SMS or screenshot.

- Set your trading hours — this prevents orders coming in when you’re offline.

That’s it — with DP2P you can easily turn your Deriv USD balance back into local currency, often faster than through banks or cards.

DP2P is one of the easiest ways to withdraw funds — but it’s not your only option.

If you want to explore other methods, here’s my full guide on

➡️ How to Withdraw from Deriv Account.

💸 What Is the Deriv Peer-to-Peer (DP2P) Withdrawal Limit?

Your DP2P withdrawal limit depends on two things:

✅ Your account verification level

✅ Your DP2P transaction history (Deriv may increase your limit over time if you build a good trading record)

Here’s a general guide:

- Minimum withdrawal via DP2P: From $1 USD (depends on seller/buyer limits)

- Maximum DP2P withdrawal per transaction: Up to $500 USD — but depends on buyer ads and your personal DP2P profile limits

- Daily DP2P withdrawal limit: $500 per day for fully verified accounts. I have seen it increased to $5,000 for high frequency DP2P users.

👉 If your account is not fully verified, or if you’re new to DP2P, your starting limit may be lower.

👉 Limits may also vary depending on your country and local regulations — check inside your DP2P > My Limits section for your exact current limits.

Pro Tip: If you plan to withdraw larger amounts often:

- Complete full verification

- Build a good DP2P trade history (successful trades, no disputes)

- Contact Deriv support if you want to request a limit review.

⭐ After Every Trade: Rate, Review & Build Your Trusted Network

One thing I see many traders overlook — what you do after a DP2P trade matters just as much as the trade itself.

After every completed order, Deriv gives you the option to rate the other trader — whether you were buying or selling.

👉 Don’t skip this step — it helps the whole DP2P community stay clean.

If the person was:

- Slow to respond

- Rude or disrespectful

- Delayed unnecessarily

Be honest — leave a low rating and a short note. It helps other traders avoid bad actors.

On the other hand — if the trader was:

- Fast

- Polite

- Professional

→ Give them a 5-star review. These ratings are public and help everyone find good trading partners.

🎯 Why Your Own Ratings Matter

Remember — you’re also being rated.

If you want to build a trusted profile (especially if you plan to sell USD often), your behavior matters:

- Respond fast

- Communicate clearly and politely

- Avoid cancelling unless necessary

Good ratings = smoother future trades. Bad ratings = fewer people willing to deal with you. Simple as that.

👥 Bonus Tip: Follow Trusted Traders

If you trade with someone reliable — click “Follow” on their profile.

Next time they post an ad, their offer will appear higher in your results.

✅ It saves you time.

✅ You already know what to expect.

✅ Trades go faster and with less stress.

Bottom line?

The more you build a small network of trusted traders inside DP2P, the better your entire Deriv experience will be — fewer delays, less risk, more consistency.

Is Deriv DP2P Safe?

One of the first questions many traders ask is:

“Is Deriv DP2P safe?” or “What if I get scammed on Deriv P2P?”

The short answer — yes, it’s one of the safest peer-to-peer funding methods available.

And here’s why:

✅ Deriv acts as an escrow on every DP2P transaction.

When you place an order:

- Deriv locks the seller’s funds temporarily — they can’t disappear with your money.

- You send payment via your chosen local method (Mobile Money, Bank Transfer, ZIPIT, etc.).

- Once the seller confirms they’ve received the payment, Deriv instantly releases the USD to your account.

✅ Dispute Resolution:

If anything goes wrong — delayed confirmation, fake proof of payment, or the seller refuses to release funds — you can immediately open a dispute.

Deriv will step in as a neutral mediator and review the entire case based on chat history and uploaded proof.

Important: Keep all chats inside DP2P. Never switch to WhatsApp, Telegram, or external platforms — Deriv cannot use those messages in dispute resolutions.

But don’t switch off your brain either.

While DP2P itself is well-built and protected, scammers do still try to steal your money through various tricks (we’ll cover those further down).

Stay vigilant — and if you follow the steps I’ll share below, you’ll avoid 99% of the common traps new traders fall into.

Bottom line:

✅ You are not alone when using DP2P.

✅ The system protects you — but you still need to trade smart.

🚨 What Is a Deriv P2P Dispute?

Sometimes things go wrong during a DP2P transaction — and that’s where Deriv P2P disputes come in.

A dispute happens when there’s a disagreement between buyer and seller.

It could be:

- The buyer says they’ve paid, but the seller hasn’t received anything.

- The proof of payment looks fake or suspicious. (Yes — I’ve been hit with this before.)

- The amount paid is incorrect or doesn’t match what was agreed.

- The payment method used isn’t what was listed in the ad.

- One party goes silent, making it impossible to complete or cancel the order.

In short — anything that puts the trade at risk.

🛡️ How Deriv Handles Disputes

If this happens, either side can open a dispute request inside DP2P.

When you do, Deriv’s support team steps in as neutral mediator.

Here’s what they’ll do:

- Review the entire DP2P chat history.

- Check proof from both sides — screenshots, bank statements, payment confirmations, timestamps.

- Make a fair ruling based on the evidence.

This is why it’s critical to keep ALL conversations inside DP2P.

Once you take chats to WhatsApp, Telegram, or anywhere outside the app — Deriv can’t use those messages to help you.

👉 If someone insists on moving the chat outside DP2P — cancel the trade immediately.

That’s often the first red flag of a scam attempt.

⚠️ Real Lessons That Saved Me (And Could Save You)

I’ve used DP2P for years now — and along the way, I’ve learned a few hard lessons.

Here are some tips that could save you the same headaches:

✅ Only Accept or Send Payments Using Accounts That Match the Deriv Name

One time, a buyer told me:

“I’m using my relative’s mobile account to send the money — is that okay?”

I said yes. The payment came through and I even gave them a good rating.

Big mistake.

A few days later, I got a call from the mobile money provider — accusing me of fraud.

Turns out, the buyer had scammed someone else into sending money using my number. I was caught in the middle.

My funds were frozen, and my account got flagged — even though I’d done nothing wrong.

🔑 Since then, I have one rule:

I only accept payments from accounts that match the buyer’s Deriv name. Period.

Don’t make the same mistake I did.

✅ Use Your Trading Hours Wisely

Back when DP2P didn’t allow setting trading hours, I once left a Sell USD ad running overnight and went to sleep.

While I was offline, a scammer placed an order, uploaded fake proof of payment, and by morning — full dispute.

Deriv had to lock my funds while investigating. The scammer vanished, and I had to prove I hadn’t done anything.

💡 Lesson:

Set your trading hours.

If you’re offline or asleep, turn your ads off.

It takes two clicks — and saves a lot of stress.

✅ Fake Screenshots Are Getting More Sophisticated

Some scammers now use tools that generate fake SMS receipts or fake payment confirmations — sometimes even using your number as the sender name.

If you’re not careful, you’ll think the payment came through — but when you check your actual balance, nothing is there.

✅ Always verify directly inside your bank app or mobile money app — not just from screenshots or SMS.

Screenshots can be faked. Your bank app cannot.

Bottom line?

These small habits — checking names, setting hours, verifying payments — will save you a lot of trouble on DP2P.

Learn from my mistakes and you’ll trade a lot safer.

🧠 Final DP2P Safety Tips (Read This Before You Trade)

DP2P has improved a lot over the years — it’s now safer, better regulated, and Deriv’s system does a good job of detecting shady behavior.

But scammers still try their luck — and your best protection is staying sharp.

Here’s what I personally recommend to every trader:

✅ Communicate only inside DP2P chat.

If someone insists on moving to WhatsApp or Telegram — cancel the trade. That’s often the first red flag.

✅ Always double-check the sender name on payments.

Only accept payments from accounts that match the buyer’s Deriv name. If it doesn’t match — cancel.

✅ Verify payments inside your bank or mobile money app — never rely on screenshots.

Fake payment confirmations are getting more sophisticated. Trust your actual balance, not what the buyer sends you.

✅ Set your trading hours — and stick to them.

Only run ads when you’re fully available to complete trades. If you’re offline or asleep, turn ads off.

✅ Review every trade.

Rate the other party after every trade. Good reviews help build your trusted network — and flag bad actors for others.

✅ Don’t rush.

If something feels off — don’t be afraid to cancel. It’s not worth the risk of getting trapped in a dispute.

✅ Be careful when trading large amounts.

For big trades, deal only with highly rated sellers or buyers you’ve worked with before.

✅ Trust your gut.

If the other person is acting strangely — delaying, changing payment methods, or giving excuses — cancel. Walk away.

Final reminder:

DP2P is a great tool — I use it all the time. But it’s not a place to switch off your brain.

If you stay alert, follow these tips, and trade smart — you’ll avoid 99% of the common traps and enjoy a smooth DP2P experience.

📲 Why Use the Deriv DP2P App?

If you’re serious about using DP2P often, the mobile app is a great tool — especially for quick trades or when you’re on the move.

✅ It’s fast and intuitive — you can fund or withdraw within minutes, straight from your phone.

✅ Built-in chat keeps you safe — all communication stays inside the app, protecting you in case of disputes.

✅ Local payment options are fully supported — from Mpesa, EcoCash, ZIPIT, Mukuru to bank transfers.

✅ Push notifications — you get instant alerts for new orders or messages, so you can respond quickly.

👉 Personally, I’ve found the app more convenient than using the desktop site — especially when traveling or doing smaller trades on the go.

If you haven’t tried it yet:

You can also use DP2P on desktop any time by going to Cashier → DP2P.

✅ Advantages of Using DP2P To Fund Your Deriv Account

Here’s why DP2P remains my go-to option for funding and withdrawing on Deriv:

✅ It’s fast and convenient.

You can fund your account in minutes — no waiting days for bank transfers to clear.

✅ Zero fees from Deriv.

Deriv doesn’t charge anything extra for DP2P. You only deal with the rate offered by the seller.

✅ Supports multiple local payment methods.

Bank transfers, Mobile Money, EcoCash, ZIPIT, Mukuru — and more. You can use what works best in your country.

✅ You can exchange your local currency easily.

Deposit in your local currency → receive USD in your Deriv account — no complicated conversions required.

✅ Escrow protection makes it safer.

Deriv holds the seller’s funds during the transaction. If there’s a dispute and you win, your funds are refunded.

✅ 24/7 Deriv support available.

If anything goes wrong, Deriv’s support team is on hand around the clock to help resolve DP2P issues.

Want to see the most popular payment methods for DP2P and Payment Agents in your country? Check out my full Deriv Deposit & Withdrawal Methods by Country guide.

⚠️ Disadvantages of Using DP2P To Fund or Withdraw From Your Deriv Account

While DP2P is an excellent tool, it’s not perfect. Here are a few things you should be aware of:

✅ Market can sometimes go flat.

There are times — especially on weekends or during off-peak hours — where there may be very few takers for your ad.

If you’re trying to sell and nobody’s buying, your ad may sit there until it expires. When this happens, the time advantage of using DP2P disappears.

✅ Increased supply can force you to drop your rate.

If you’re selling USD and suddenly a lot of sellers flood the market, you may be forced to reduce your rate to stay competitive — otherwise your ad will be ignored. This can eat into your profits.

✅ A typing error can be very costly.

I once posted a Sell USD ad and accidentally entered $120 instead of $1,200.

A sharp buyer caught it instantly and jumped on the deal. Since I was the one who set the rate, I had no recourse — the transaction went through and I lost money. It wasn’t theft — it was my own mistake.

Now I always cross-check my ads carefully before posting. You should too.

✅ Ad blockers and time-wasters.

Some people will place an order just to block your ad (making it invisible to other buyers), then cancel after an hour.

This wastes your time and reduces your chances of selling at your target rate. You can’t really do anything about it — but one way to protect yourself is to always check completion stats on the buyer’s profile before dealing with them. Low completion rates = avoid.

✅ Dispute resolution can take time — even if you’re right.

If a dispute arises and you’re the wronged party, your funds will be held in escrow while Deriv investigates — and the process can take up to 3 days as they wait for the counterparty to respond.

While fair, this is still a major inconvenience — especially if you needed the funds urgently.

✅ Buyers sometimes disappear mid-trade.

It happens — you place an ad, a buyer accepts, and then they go silent or disappear mid-transaction. You’ll need to wait for the timer to run out or cancel yourself — frustrating, but part of the game.

The good news?

👉 Many of these issues are slowly being addressed in newer versions of the DP2P app:

- Better completion stats visible upfront.

- Improvements in how ad locking and order timeouts are handled.

- Faster dispute handling and more transparent processes.

But like any peer-to-peer system — it’s not perfect. You still need to trade smart, stay alert, and manage your risk.

🧾 Final Thoughts: DP2P + Payment Agents = Flexible, Reliable Funding

Since launching DP2P in 2021, Deriv has completely changed the game for funding and withdrawing — especially in markets where international cards and banks aren’t reliable.

Right now you have two excellent options:

✅ Want fast, self-managed trades? → Use DP2P.

✅ Prefer working through a trusted local partner? → Use a Deriv Payment Agent.

I’ve used both over the years — and I can tell you:

There’s no longer any excuse for struggling to fund or withdraw from your Deriv account.

Between these two methods, you can manage your money safely, quickly, and with full control.

👉 If you want to go deeper, check out these related guide:

➡️ How to Deposit and Withdraw from Deriv Account Using Payment Agents

Whether you’re just getting started or looking to scale up — choose the method that fits your style and trade with confidence.

Conclusion

DP2P is one of the best tools we have as Deriv traders — if you know how to use it well.

It’s fast, flexible, and gives you more control over your money than most traditional methods.

But like any peer-to-peer system, it’s not foolproof — you still need to trade smart, stay alert, and build your network of trusted counterparties.

Personally, DP2P has saved me time and costs many times over — and once you get used to it, you’ll likely find the same.

👉 Have you used DP2P? What tips or experiences would you share with other traders?

Drop your comments below — let’s help each other trade safer and smarter.

🔗 Related Guides

If you found this guide useful, here are a few more that will help you get even more out of your Deriv trading:

- How to Trade Deriv Synthetic Indices Profitably — Real tips to help you grow your Deriv account once funded.

- Volatility Indices Guide — Deep dive into how Volatility Indices work and how to trade them.

- Synthetic Indices Lot Sizes Explained — Understand how lot sizes work and manage your risk correctly.

- Best Time to Trade Synthetic Indices on Deriv — When to trade for the best market conditions.

- Deriv Copy Trading Review — Should you use copy trading on Deriv? Full review of the platform.

Frequently Asked Questions On DP2P

DP2P stands for Deriv Peer-to-Peer. It is a service that allows you to fund and withdraw from your Deriv account by exchanging your local currency with other Deriv traders.

Log into your Deriv account → go to Cashier → DP2P.

You can then buy or sell USD using local payment methods like Mobile Money or Bank Transfer. The process is fully protected by escrow.

No — you must fully verify your Deriv account to use DP2P. This protects you and other traders, as DP2P involves real-money transactions.

DP2P allows you to fund and withdraw through direct peer-to-peer transfers using local payment methods — no banks, cards, or third-party wallets required. It’s fast, flexible, and protected by escrow.

Deriv does not charge any fees for using DP2P. You only pay the exchange rate offered by the buyer or seller — no extra fees from Deriv itself.

Most DP2P transfers are completed within minutes once both sides are online. To avoid delays, always chat with the other trader first to confirm they are ready.

DP2P availability depends on your country and local regulations. To check if it’s available for you, log into your Deriv account → Cashier → DP2P. If the tab is visible, it’s supported in your country.

If you have any issues using DP2P, contact Deriv Customer Support for help. Their team is available 24/7 to assist with any DP2P-related problems.

The Deriv DP2P app is one of the best options for fast, flexible deposits using local payment methods. You can also deposit via the main Deriv website using Payment Agents or bank cards.

Read Review

OPEN AN ACCOUNT

Read Review

OPEN AN ACCOUNT

Min Deposit: USD 1

Total Pairs: 100+

Regulators: MFSA, LFSA, VFSC, BVIFSC

💼 Recommended Brokers to Explore

Other Posts You May Be Interested In

10 Least Volatile Volatility Indices on Deriv (Full 2025 Guide) 🐢

Not every trading session calls for chasing wild spikes. Sometimes the goal is precision, consistency, [...]

Best Days & Times to Trade Synthetic Indices on Deriv in 2025 🕰️

Timing is half the battle—yet most blogs toss out random “best times to trade” with [...]

XM Account Types Review (2024) ☑ Choose The Right One ⚡

In this comprehensive review, we look at the different XM account types, to show you [...]

🤖 Deriv Even Digit Bot – Oryx Strategy Explained

If you prefer a calm, patient style of trading — Oryx might be the perfect [...]

Varus – Deriv Under 5 Bot with Safe PLS Recovery Strategy (2025)🤖

If you’re looking for a Deriv under 5 bot that thrives on low-digit strength and [...]

HFM Demo Account Review 🎮Practice Your Strategies Risk-Free

In this review, we will explore the features and benefits of the (HotForex) HFM demo [...]