When I started trading Deriv’s synthetic indices in 2016 I stuck exclusively to MT5 because it was the only available platform. Fast forward to 2025, the broker has had major improvements and now has a number of platforms for trading synthetic indices on Deriv. This has given traders a lot of convenience and options.

The downside is that if you are just starting out, there is a risk of overwhelm. You may not know which one to choose for your trading style.

So I have done the heavy lifting for you so that you don’t have to spend countless hours manually testing all of them, and risk making silly mistakes that can blow your account.

In this guide I will walk you through each Deriv platform and show you the best trading conditions each is suitable for and how you can get started with each. I will break it down in simple terms, just like if I was walking you through on a Zoom call.

Read Review

OPEN AN ACCOUNT

Read Review

OPEN AN ACCOUNT

Min Deposit: USD 1

Total Pairs: 100+

Regulators: MFSA, LFSA, VFSC, BVIFSC

Are you a complete newbie to synthetic indices?

If you’re new to synthetic indices on Deriv, they’re algorithm-driven, 24/7 markets that simulate real-world volatility. For a full breakdown of how they work, check out our main guide here.

What Platforms Can You Use to Trade Synthetic Indices?

There are seven platforms for trading synthetic indices on Deriv namely:

- Deriv MT5 (DMT5)

- DTrader (Web-based)

- Deriv Bot (No-code automation)

- Deriv X (Multi-asset platform with TradingView charts)

- SmartTrader (Lightweight options interface)

- Deriv GO (Mobile app)

- Deriv cTrader

Let’s break each of these platforms for trading synthetic indices on Deriv down.

1. Deriv MT5 (DMT5)

This is still my favourite Deriv platform after all these years. Deriv’s version of MT5 lets you trade all synthetic indices with full charting tools, custom indicators, EAs (robots), and advanced trade management features.

Who Should Use MT5

- Algorithmic traders developing EAs or using third-party indicators (e.g., Trend-Pullback scripts). I actually run my CFD trading bots on DMT5

- Serious technical analysts who need multi-timeframe analysis, advanced drawing tools, and custom oscillators.

- Professional traders who intend to run backtests and optimized genetic algorithm passes before going live.

- I’ve tested this by running my AI v2 filter on M1 engulfing signals: backtests finished in under 2 minutes on a 6-month V75 1s dataset, compared to 10 minutes on other platforms.

Another advantage of mt5 is that I can load other accounts from other brokers and switch seamlessly.

For a detailed, step-by-step walkthrough (with screenshots) on downloading MT5, logging in, adding synthetic indices, adjusting lot size, placing orders, and more, see our dedicated guide:

➡️ Trade Synthetic Indices on MT5 (with Screenshots)

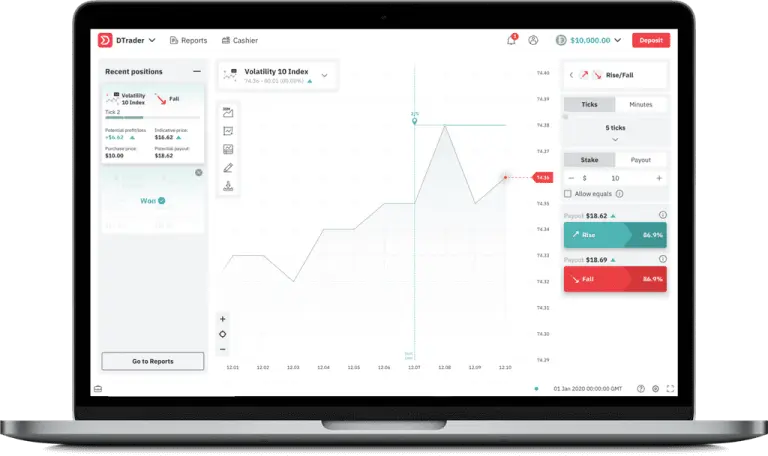

2. DTrader (Web-based)

Deriv DTrader is Deriv’s proprietary web-based platform, built from the ground up for options-style trading and multipliers. It’s lightweight, loads quickly in your browser, and offers a clutter-free interface.

When I first tried DTrader in 2022, I appreciated how easily I could toggle between volatility indices (like V75 and V100) without having to install anything locally.

Key Features:

- Drag-and-drop chart tiles: Arrange multiple charts side by side (e.g., V75 1s on one tile and V75 5s on another).

- Customizable timeframes: From 1s ticks up to 60 min candles.

- Built-in technical indicators: RSI, MACD, Bollinger Bands, and more.

- Preset “Multiplier” options: Scale position size automatically based on selected multiplier.

- Risk management tools: Automatic “Sell at profit” and “Sell at loss” orders for ladder strategies.

- Demo mode on the same URL: Switch between demo and real accounts in one click.

Who Should Use DTrader?

DTrader is ideal for option-style traders who prefer one-click entries and exits, as well as scalpers focusing on ultra-short expiries—down to one or five seconds—thanks to its sub-second chart refresh.

New traders also benefit because there’s no need to install software or fiddle with complex settings; everything is accessible through the browser.

In my own experience, I ran a V75 1s “Buy” and “Sell” strategy on DTrader, and its low latency kept slippage to under three points even during the most volatile moments of the Asia session.

How to Get Started

- Log in at

app.deriv.com/dtraderand select your synthetic index (e.g., “V75 (1s) Volatility Index”). - Choose your trade type: Up/Down for classic options, or use Multiplier if you want to specify risk/reward.

- Set your stake (e.g., $0.10) and decide an expiry (1 sec, 5 sec, 10 sec, etc.).

- Add indicators: Click the “Indicators” icon at the top, pick RSI (14), and watch for overbought/oversold during ranging markets.

- Place your trade with one click, then toggle between demo and real mode as you refine your strategy.

Real Tip: When trading 1s expiries, I keep a separate chart on 5s candles to confirm momentum, since a single tick can flip direction twice in a row. That extra context prevented me from chasing fake breakouts during low-volume periods.

3. Deriv Bot D(rag-and-Drop Automation, No Coding Needed)

Before I learned to code bots, I felt lost trying to figure out automated trading after watching countless videos.

When Deriv introduced its Bot Builder, I was relieved to discover that I could assemble a fully functional bot simply by dragging and dropping blocks to match my strategy—no developer fees or VPS rentals required.

Even better, the available templates let me tweak existing logic instead of starting from scratch, so I could have a personalized trading bot up and running in no time.

Who Should Use DBot?

Deriv Bot is perfect for non-coders who want to automate simple trading rules without writing any code—especially manual traders looking to “set and forget” their strategies.

It also appeals to strategy testers who need to prototype quickly rather than wait for an EA developer. Because it runs entirely in your browser or on mobile, you can build and deploy a bot on the go without installing anything.

I’ve tested this firsthand by creating a V75 1s Martingale bot: within minutes, I had logic in place that doubled up after every loss and capped at five orders to prevent runaway drawdowns.

How to Get Started

- Log in to Deriv, click “Bot” on the left sidebar.

- Create a new bot, name it (e.g., “V75 Engulfing + H1 Trend”).

- Drag “Purchase Condition” block → set “Symbol = V75USD” and “Indicator = M15 Bullish Engulfing.”

- Add a “Tick Analysis” block → “Timeframe = H1” → “MA > MA” to confirm trend direction (e.g., 50 EMA above 200 EMA).

- Connect “Place Order” block with parameters: Stake = $0.10, Duration (Expiry) = 1 sec, Type = “Up.”

- Attach “Stop-Loss/Take-Profit” block if you want fixed SL (40000 points) and TP (120000 points).

- Click “Test”, let the bot run on demo for 1000 ticks, then review the “Logs” tab for every decision.

- Switch to “Live” once comfortable, adjust Max Consecutive Losses to 3 to prevent account wipe during whipsaws.

Real Tip: Always start with a demo run of at least 2 000 ticks. That ensures your logic handles edge cases (e.g., rapid H1 trend flips) before you risk real equity.

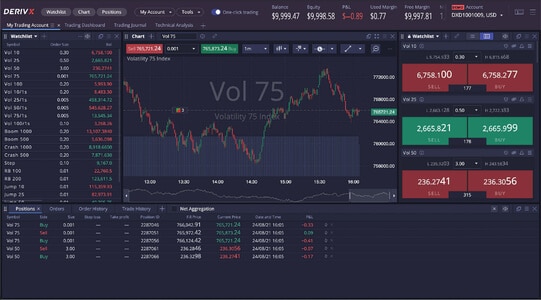

4. Deriv X (Multi-Asset Platform for Indices, Crypto, Forex, & More)

Deriv X is Deriv’s newest multi-asset trading platform—available as a web app and mobile app. While it’s known primarily for forex and cryptocurrencies, it also supports synthetic indices via a unified interface.

If you’re diversifying beyond V75 into, say, BTCUSD or Crash 300, Deriv X lets you switch without jumping between platforms.

Trading synthetic indices on Deriv X is only available with a Standard account.

👉 Want to see exactly how the TradingView integration on Deriv X works?

➡️ Here’s our full breakdown.

Key Features:

- Charting powered by TradingView: 100+ indicators, multiple chart types, and drawing tools.

- Custom “Watchlists”: Monitor your favorite assets (e.g., V75 1s, Volatility 100 1s, BTCUSD M1) in one sidebar.

- Order types: Limit, Market, Stop-Limit for indices—so you can, for example, set a “Buy Limit” on a V100 dip instead of instant Tick Purchase.

- Mobile app sync: Build alerts on desktop, receive push notifications on your phone.

- Zero commissions on indices: Only pay the spread (which is around 50–60 points on V75 1s during major sessions).

Who Should Use Deriv X?

Deriv X is designed for traders who juggle multiple asset classes—whether that’s synthetic indices, cryptocurrencies, or forex—all within a single platform.

It’s especially appealing to chart enthusiasts who favour the familiar TradingView interface, complete with custom scripts and advanced drawing tools.

At the same time, position traders working on higher timeframes (such as M5, M15, or H1) will appreciate the ability to place precise limit orders and manage risk more effectively.

I tested this setup by running a V75 5s breakout strategy on M1 candles while simultaneously scalping BTCUSD on a one-minute chart; Deriv X handled dual chart windows seamlessly, and its notification system kept me alert to cross-asset signals at all times.

How to Get Started with Deriv x

- Sign in to Deriv X via browser or install the mobile app.

- Under “Markets,” expand “Synthetic Indices,” select “Volatility 75 (1s).”

- Open a chart, click the “Indicators” icon (TradingView menu) and add your preferred scripts (e.g., VWAP, custom Fibonacci panel).

- Set a “Buy Limit” at your desired price (e.g., if you believe V75 will dip to 12 3000 before reversing).

- Use “Alert” (bell icon) to notify you when price crosses key levels on any timeframe.

- Test in “Deriv X Demo” first—click the profile picture and toggle “Demo Mode” on/off to switch seamlessly.

Real Tip: If you’re a swing trader eyeing V75 H1 patterns, use the “Extended Market Hours” indicator to highlight periods when volume typically spikes (e.g., 08:00–12:00 GMT+2), then place limit orders during Asian session draws.

Need Help Choosing Between MT5 and Deriv X?

We’ve tested both. Here’s the full breakdown.

5. Deriv SmartTrader: Simple, Clean, and Built-for Beginners

SmartTrader is Deriv’s simplified options platform—ideal if you’re brand-new to synthetic indices or strictly want to trade classic Up/Down options without indicators.

The UI is minimal: pick your index, choose stake and expiry, then click Up or Down. It loads in any modern browser (even on low-end PCs and Chromebooks).

Key Features:

- Very low resource usage: Even older laptops can run multiple SmartTrader tabs without lag.

- Preset popular expiries: 5 sec, 15 sec, 30 sec, 1 min, 5 min.

- Candlestick chart with zoom: While basic, it’s usable—just don’t expect advanced drawing tools.

- Prebuilt strategy suggestions: “5 sec scalp,” “1 min momentum,” based on recent historical patterns.

- Guaranteed fills: No requotes—entry and exit pricing are fixed once displayed.

Who Should Use Deriv Smart Trader?

SmartTrader is ideal for absolute beginners who just want to click Up or Down without worrying about indicators. It also works well on low-spec devices that can’t handle MT5 or other feature-heavy platforms.

For impulse traders focusing on ultra-short-term expiries—five to thirty seconds—SmartTrader’s minimal interface keeps distractions to a minimum.

How To Use Deriv Smart Trader

To get started, open your browser and navigate to app.deriv.com/smarttrader, then log in using your Deriv credentials. Once you’re in, head to the “Synthetic Indices” section and select “Volatility 75 (1s).”

After choosing V75, input your desired stake—for example, $0.20—and set your expiry to 15 seconds. From there, simply click “Up” or “Down” to place your trade; SmartTrader will handle all the backend order processing automatically.

While trading, keep an eye on the small candlestick chart in the corner of the screen. Even though the interface is minimalist, glancing at that chart before each click helps you confirm the current price direction and make more informed entry decisions.

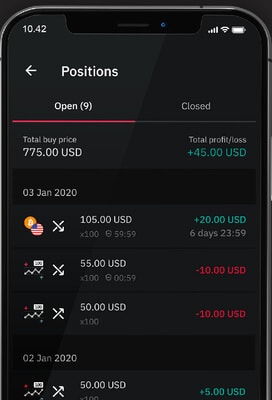

6. Deriv Go: Mobile Trading Made Easy

Deriv GO is Deriv’s mobile app (iOS/Android), optimized for quick entries on the go. While it doesn’t match desktop platforms for complex automation, it’s perfect for catching intra-day moves when you’re away from your desk.

Key Features:

- Optimized for data usage: Low bandwidth, so price updates remain smooth even on 3G.

- One-tap trade interface: Tap “V75 1s” → “Up/Down” → “Stake” → “Confirm.”

- Push notifications: Set price alerts and be notified when your target is hit.

- Mobile-friendly charting: Basic candlesticks, plus one indicator at a time (e.g., RSI 14).

- Demo/Real toggle: Switch accounts without logging out.

Who Should Use Deriv Go?

Deriv GO is perfect for traders on the move who need to manage positions or scalp quick one-second expiries while traveling or away from their desk.

It also serves as a reliable backup for traders who already have open positions on DTrader or MT5, allowing them to monitor their trades on the go.

Additionally, lightweight strategists running simple breakout tactics will appreciate Deriv GO’s mobile interface for keeping an eye on midday price patterns via their phone.

To get started, simply download the app from Google Play or App store and log in with your Deriv credentials.

7. Deriv cTrader

When I first started trading synthetic indices back in 2016, there was no copy-trading option. As a newbie, your best bet was hunting for “synthetic indices account managers,” and most turned out to be scammers gambling with your money.

Today, the playing field has changed: Deriv cTrader lets you copy-trade synthetic indices just like forex. You simply browse a list of strategy providers, check their performance stats—win rate, drawdown, average holding time—and allocate a portion of your capital to mirror their trades automatically.

Behind the scenes, cTrader’s infrastructure replicates orders almost instantly, and you only pay a commission on trades that make profit—no hidden subscription fees or complex licensing.

Deriv cTrader is a social copy-trading platform that lets you mirror successful traders in real time. Instead of building your own strategies or learning every market nuance, you browse through a ranked list of verified providers, review detailed performance metrics, and allocate funds to copy their trades.

The advanced infrastructure ensures orders are passed to your account with minimal delay, and you only pay commission on profitable trades—no subscription fees or licensing hassles.

Who Should Use Deriv cTrader?

Deriv cTrader is best suited for traders who want exposure to synthetic indices without developing or coding their own strategies.

If you’re new to synthetic indices but want to learn by observing seasoned traders, cTrader lets you start copying top performers immediately.

It’s also ideal for those who lack the time to monitor charts all day: by splitting your capital across multiple verified providers, you can diversify risk and let their expertise drive your results.

Even experienced traders use it to balance a portfolio—allocating some funds to conservative trend followers while testing higher-risk scalpers in a single dashboard.

For a deeper dive into how cTrader works—complete with performance metrics, fee structure, and step-by-step setup—check out our full review:

Deriv cTrader Review

Which one is the best platform for trading synthetic indices on Deriv?

There isn’t a single “best” platform—different traders have different needs, and Deriv’s suite caters to everything from simple option-style bets to full-featured CFD trading.

If you want a straightforward, one-click options interface with minimal setup, SmartTrader or DTrader is ideal: both let you pick a synthetic index, choose an expiry, and click Up/Down.

SmartTrader is especially lightweight for ultra-short expiries (5–30 seconds), while DTrader adds charting and multipliers for traders who want some technical context without installing software.

For those who prefer CFD-style trading with advanced charting and backtesting, Deriv MT5 stands out. MT5 gives you 21 timeframes (even 1s tick charts), custom indicators, Expert Advisor support, and a strategy tester.

If you want to combine synthetic indices with other asset classes (like forex or crypto) in a single window, Deriv X offers TradingView-powered charts and more sophisticated order types (limit, stop-limit) that let you fine-tune entries.

Deriv cTrader is perfect for those who want a hands-off approach by copying proven synthetic indices strategies in real time, with no coding required.

You can diversify risk by allocating small portions of your capital to multiple strategy providers and only pay commissions on profitable trades.

Finally, if you don’t know how to code but still want to automate rules—such as entering a V75 1s Martingale or an engulfing+crossover strategy—Deriv Bot is the easiest option. You drag and drop logic blocks, test on demo, and go live in minutes.

And if you need mobile access to manage or scalp positions while on the go, Deriv GO keeps you connected with one-tap trade entries and push alerts.

In short, choose SmartTrader or DTrader for simple option bets, MT5 for in-depth CFD-style analysis and automation, Deriv X for multi-asset/TradingView flexibility, and Deriv Bot or GO for no-code automation and mobile convenience.

🔗 Related Guides

➡️ Synthetic Indices vs Forex – A head-to-head comparison showing how synthetic indices differ from and complement forex trading.

🐢 Least Volatile Synthetic Indices on Deriv – A guide to the synthetic indices that exhibit the lowest volatility, ideal for more conservative strategies.

♻️ Deriv Copy Trading Review – In-depth analysis of Deriv’s copy-trading feature, covering functionality, fees, and how to follow top traders.

⚖️ Lot Sizes Synthetic Indices – Explanation of how lot sizes work on synthetic indices and guidance on selecting appropriate stakes for your risk level.

Share Your Experience

Now it’s your turn: which platform for trading synthetic indices on Deriv is the best for you?

What makes it stand out for you? Was it difficult or easy to learn when you first started, and what tips would you offer to someone new to that platform?

Share your thoughts in the comments below so we can all grow together as traders.

FAQs on Platforms for trading synthetic indices on Deriv

MT5 has the most robust backtesting environment (Strategy Tester with tick replay). Deriv Bot offers demo testing of logic blocks but lacks full tick-by-tick backtests. For detailed metrics (drawdown, streaks, equity curve), MT5 is the clear winner.

You can toggle between demo and real on DTrader, Deriv Bot, and Deriv X within the same login. MT5 requires you to choose “Deriv-MT5-Demo” or “Deriv-MT5-Real” server at login, but you keep the same credentials. SmartTrader and Deriv GO share your central Deriv account for demo/real.

There’s no single “best” platform—your choice depends on your trading style. If you prefer one-click options with minimal setup, DTrader or SmartTrader is ideal, whereas MT5 is better for CFD-style analysis, custom indicators, and backtesting. For no-code automation or mobile scalping, Deriv Bot and Deriv GO provide easy drag-and-drop logic and one-tap trade entries.

💼 Recommended Brokers to Explore

Other Posts You May Be Interested In

Top Platforms for Trading Synthetic Indices on Deriv: A Complete Guide

📅 Last updated: June 27, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Taylor [...]

Volatility Indices on Deriv: Full Guide to Types, Lot Sizes, Volatility Levels & Best Strategies (2025)

📅 Last updated: June 23, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Taylor [...]

Exness Account Types Review 2024 🔍A Comprehensive Guide

📅 Last updated: December 7, 2023 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Taylor [...]

10 Least Volatile Volatility Indices on Deriv (Full 2025 Guide) 🐢

📅 Last updated: June 12, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Taylor [...]

How to Trade on Deriv X: A Comprehensive Guide 📈

📅 Last updated: October 13, 2023 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Taylor [...]

MT5 vs Deriv X: Which Platform Should You Use in 2025? 💻

📅 Last updated: June 27, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Taylor [...]