Synthetic indices from Deriv have exploded in popularity—especially across Africa and India—despite being less than a decade old. Back in 2016 when I first traded V75, only a handful of us were in the game.

Fast-forward to today, and there are WhatsApp, Telegram, and Facebook groups bursting at the seams, plus countless YouTube channels dedicated to these algorithm-driven markets.

In this post, I’m laying out the unvarnished advantages and disadvantages of trading synthetic indices on Deriv. No sugarcoating, no hype—just the raw facts so you can decide if they belong in your trading arsenal.

Are You A Complete Newbie?

If you’re new to synthetic indices and want an in-depth, beginner-friendly breakdown of how they work, start with our full Synthetic Indices Guide.

Read Review

OPEN AN ACCOUNT

Read Review

OPEN AN ACCOUNT

Min Deposit: USD 1

Total Pairs: 100+

Regulators: MFSA, LFSA, VFSC, BVIFSC

Advantages Of Trading Synthetic Indices From Deriv

✅1. Synthetic Indices are not affected by fundamental events

One of the coolest things about synthetic indices is that they don’t blink at Fed meetings or flash-crash on war headlines—they simply follow their coded algorithms. Think of them as a mirror to market behavior, not a hostage to fundamentals.

If you’ve spent any time in forex, you know how quickly a surprise interest-rate hike can turn calm into chaos. Just look at CAD pairs after the Bank of Canada’s last rate decision—your screen lights up with massive spikes and whipsaws in seconds.

Below is a screenshot of EUR/CAD tearing higher on that BOC announcement—contrast that with the rock-steady drift you get on, say, Crash 1000 or V50 Normal, and you’ll see why many traders love the algorithm-driven consistency of synthetic indices.

Pro Tip: In forex you also see wild swings on NFP, CPI, and other data—so synthetic indices let you skip the newsfeed and focus purely on price action.

✅2. Synthetic Indices are Available 24/7/365 —No Market Holidays

A major advantage of synthetic indices is they never clock out. While forex and stock markets pause for weekends, holidays, or news events, Deriv’s synthetic indices keep rolling every minute of every day.

That means:

- Trade on your schedule: Early bird in Asia or night owl in the Americas—you’re always in the game.

- No holiday gaps: Missing a major announcement? No stress, since the markets don’t shut down.

- Consistent backtesting: Your demo results translate directly to live—no sudden weekend gaps to skew your data.

For busy traders, that round-the-clock availability makes synthetic indices a go-to—so you never have to choose between your day job and trading.

✅3. Tailored Volatility Options on Deriv

One of the biggest advantages of trading synthetic indices is you can dial in the exact volatility level that suits your style. Prefer a slow, steady ride? Pick the tortoises—V10 and V25—for controlled, practice-friendly moves. Crave excitement? The hares—V75 or V100 (1s)—deliver rapid, aggressive swings.

Beyond pure volatility indices, you’ve also got the Boom & Crash, Range Break, and Jump families to chase bursty spikes or structured breakouts.

👉 Ready to zero in on your perfect index?

With these options, you control your risk and match your setups to the market’s mood—whatever your experience level.

✅4. Razor-Thin Spreads & Built-In Gearing

One of the biggest advantages of trading synthetic indices is their fixed, ultra-narrow spreads—often as low as 0.03 points on indices like V50 (Normal) or Crash 1000. That means your cost to enter and exit trades stays rock-steady, unlike forex where spreads can balloon around news.

Plus, with low margin requirements, you get high effective gearing on tiny moves. For example:

- V50 (Normal) spreads sit around 0.03 points, margin ≈1% → you control $1,000 of notional with just $10.

- Crash 1000 spreads of 0.05 points, margin ≈2% → a small account still lets you ride full-sized swings.

Put simply, predictable, tight spreads plus small margin needs give you the power (and control) to punch well above your deposit—without hidden costs dragging on your P/L.

✅ 5. Synthetic Indices can Be Traded using Pure Price Action—No Indicators Required

If you’re a price-action trader, synthetic indices feel like home turf. Their charts light up with classic signals—pin bars, M & W reversals, engulfing bars, head-and-shoulders, you name it.

Because these markets aren’t swayed by earnings reports or central-bank chatter, you get clean pattern setups every session:

- Pin Bars: Perfect rejection wicks on V25 or Crash 1000, signaling sharp reversals.

- M & W Formations: Clear double-tops and bottoms on Range Break and Step indices.

- Engulfing Bars: Strong continuation candles on Boom 300 or Jump 10 that you can ride confidently.

In short, if you trade price action in forex, you’ll feel right at home on synthetic indices—just load your favorite setups and let the algorithm-driven markets do the rest.

✅ 6. Start Trading with Pocket Change

One of the standout perks of trading synthetic indices is you can begin with almost nothing—Deriv doesn’t enforce a minimum deposit on your DMT5 synthetic account. Technically, you could transfer $1 and place your first demo (or micro) trades.

That means:

- True micro-accounts: Test strategies on a $1–$5 balance before scaling up.

- No entry barriers: You decide exactly how much skin you put in the game.

Just keep in mind: every index has its own margin requirement and minimum lot size, so your $1 might cover a 0.001 lot on V25 but won’t work if the minimum is 0.20 lots on Boom 1000. Always check the specs:

- Volatility Indices: Min lot = 0.001; margin ≈ 1%

- Boom & Crash: Min lot = 0.20; margin ≈ 5%

- Step & Range Break: Min lot = 0.10; margin ≈ 2–3%

- Jump Indices: Min lot = 0.01; margin ≈ 1–2%

By matching your tiny balance to the right index and lot size, you get hands-on experience without risking more than pocket change. That’s how you learn fast—without burning through your bankroll.

Other Advantages of Trading Synthetic Indices

- Risk-Free Demo Trading / You can

demo trade synthetic indices

Dive into every index on MT5 or DTrader with $10,000 in virtual funds—test strategies, paper-trade setups, and learn each instrument’s quirks without ever risking real money.

- Fair, Audited Algorithms (

synthetic indices fairness audit)

These aren’t rigged markets. Deriv’s synthetic indices use a random-number generator that’s independently audited, so you know you’re trading a level playing field—no manipulation or fixing.

- Know Your Exact Risk (

synthetic indices risk management)

When you place a trade, your maximum loss is transparent from the start—no hidden margin calls, no nasty surprises.

- Deep Liquidity & Fast Execution (

synthetic indices liquidity)

Whether you’re running a $50 micro account or a $50,000 pro account, you’ll always get your fills instantly—24/7, no slippage during quiet hours, no gaps on weekends.

- Perfect Training Ground (

synthetic indices training)

Synthetic indices offer a controlled environment to master price action, ATR setups, and trend-following—think of it as the ideal stepping stone to forex pairs or stock indices.

- Continuous Innovation (

new synthetic indices)

Deriv constantly rolls out new indices—so you’ll always have fresh markets to explore as R&D drives the next algorithm-driven instrument.

- Gap-Free, Automated Ready (

automated synthetic indices trading)

With nonstop quotes, you can hook up EAs, bots, or Smart Trade and never worry about weekend gaps or refresh lags—perfect for algo traders.

- No Negative Balances (

synthetic indices no negative balance)

Losses stop at zero. You can’t fall into debt, even on the most volatile indices.

- Multiple Trade Types & Platforms (

synthetic indices CFDs options multipliers)

Choose CFDs, options, or multipliers on platforms like DTrader, DMT5, Deriv X, TradingView, DBot, cTrader, or the Deriv Go mobile app.

- Flexible Funding Options (

synthetic indices funding)

Deposit via cards, e-wallets, crypto, or DP2P—whatever suits your region and budget.

Each of these perks adds up to one thing: synthetic indices on Deriv give you a transparent, always-on, and highly adaptable playground—whether you’re a newbie or a seasoned pro.

These advantages have resulted in many traders choosing synthetic indices over forex trading.

Disadvantages of Trading Synthetic Indices

1. Single-Broker Exposure (synthetic indices broker)

Why it matters:

For years, Deriv has been the only reliable home for synthetic indices—these markets are proprietary, so you simply couldn’t find them anywhere else.

Recently, a new player called Weltrade has jumped into the ring, offering synthetic indices for the first time. While Weltrade has been around for a while, their synthetic offering is brand-new, and other brokers have tried (and quietly dropped) similar products in the past.

Impact on you:

Right now, Deriv remains your go-to, with the deepest liquidity and proven stability. If Deriv shifts spreads, changes margin rules, or suffers a server hiccup, you have no other fallback—unlike forex traders who can switch brokers instantly. Weltrade is worth watching, but proceed carefully: their synthetic indices haven’t yet stood the test of time.

What to watch:

- Deriv announcements: Keep an eye on Deriv’s server-maintenance notices, margin-rule updates, or any tweaks to their RNG-based volatility engine—any change can force you to revisit your entire strategy.

- Weltrade’s progress: Monitor how Weltrade’s new synthetic indices perform—check their spreads, uptime, and overall execution quality. If you’re curious, you can explore their offering here: ➡️ Learn more about Weltrade’s Synthetic Indices. Treat it like a demo until you’re confident it’s as rock-solid as Deriv.

By staying tuned to both Deriv’s proven track record and Weltrade’s newcomer status, you’ll know exactly where to place your trust—and when to adjust if the landscape shifts.

2. Algorithm Changes Can Shift Volatility (algorithm changes synthetic indices)

Why it matters:

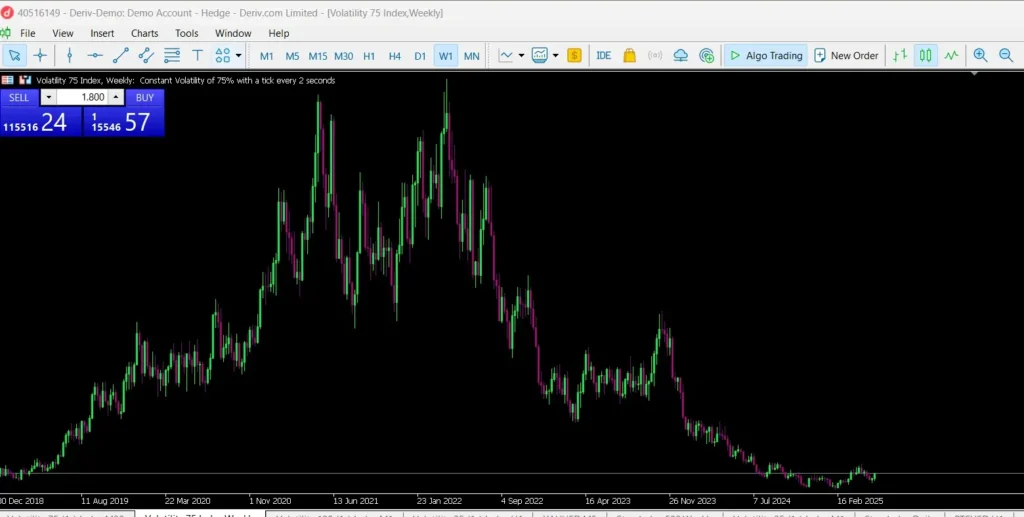

Synthetic indices live and breathe on Deriv’s randomized algorithms—and Deriv’s R&D team occasionally tightens or recalibrates those models. Take Volatility 75 (V75) for example: a couple of years ago, its average weekly swing could blast you $500→$10,000 in a day if you rode the momentum right.

Today, that same V75 barely flutters—its weekly range has flattened dramatically since mid-2022 (see chart below). When Deriv “tightens the bolts,” typical swing sizes shrink, and momentum that once felt like a freight train becomes a slow crawl.

Impact on you:

- Obsolete setups: Backtests you ran on V75’s 2019–2021 data likely won’t hold up now. A strategy built on five-dollar half-hour swings can’t survive $1 swings.

- Diminished profit potential: Traders who used to double accounts in hours find it tough to crack even modest targets. Your risk/reward narrows overnight, and suddenly those rapid-fire bounce trades don’t bank $1,000—maybe $50.

- No alternative broker: Since Deriv is still (for all practical purposes) the only broker offering V75, you can’t shop around for a “faster” V75 elsewhere. If Deriv dials back volatility, that slowdown is baked in.

What to watch:

- Deriv’s volatility-update announcements: Whenever they release patch notes—especially around V75 or any other index—jump into demo immediately and re-validate your core entries, exits, and stop-loss levels.

- Average swing surveys: Keep an eye on weekly or monthly swing reports (like our chart) to see if other indices are trending higher (e.g., newer “Turbo” versions) or if V75 is still stuck in a narrow range. A sudden uptick or further flattening should trigger a strategy tweak before you risk real money.

3. No Fundamental Hedging (synthetic indices no news impact)

Why it matters: In forex, you can hedge a USD long with EUR/USD short during NFP week or adjust positions against crude oil news. Synthetic indices have no underlying economic asset—they move purely on algorithmic randomness plus order flow.

- Impact on you: You can’t offset a losing position by trading another correlated asset. If you get caught in a sequenced crash on Crash 500, there’s no hedge—your only defense is a stop-loss.

- What to watch: Rely heavily on technical analysis. Without fundamentals, every trade must be justified by price action patterns, session timing, or volatility metrics—no “news filter” to bail you out.

4. Constant Market Risk & Overtrading Temptation (24/7 trading risks)

Why it matters: Synthetic indices never sleep—weekends, holidays, midnight UTC, you name it. That 24/7 availability is a double-edged sword. On one hand, you can trade anytime; on the other, there’s no natural resting period.

- Impact on you: It’s easy to fall into “always watching” mode, chasing setups at 3 AM or refiring trades when you should be sleeping. Overtrading churns commissions and slay your equity over time.

- What to watch: Build a session-based plan (see our “Best Times to Trade” guide). Block off “office hours” for synthetic indices, and stick to them—just like a stock trader avoids after-hours noise.

5. Margin & Leverage Dangers (synthetic indices margin calls)

Why it matters:

Synthetic indices on Deriv come with low margin requirements—often between 1% and 5%. That means you can control a large notional position with a small deposit. For example, on Volatility 25 (V25), a 0.001 lot translates to roughly $14.86 USD risk per 30-minute swing. If you size your position incorrectly, a tiny $15 swing can wipe out 15% of a $100 account.

Impact on you:

- Rapid liquidations: Misjudge your lot size, and a single surprise move on a fast index like V100 (1s) at 0.01 lot (where a 100-point swing is $9.90) can eat through your entire micro-account in a heartbeat.

- False confidence on demo: Demo-testing with huge balances without adjusting to live conditions means your real account might blow up before you even notice.

Integrated Example from Our Lot-Size Guide:

- Consider Jump 10: At a minimum 0.001 lot, one point equals $0.001. A 100-point reversal = 100 × $0.001 × 0.001 = $0.0001. In practice, you need a $50 demo at 0.01 lot to risk about $0.50 per 50-point move—keeping you close to the recommended 1% risk.

- On Crash 1000, a 0.001 lot has a point value of $0.00002. A 1,000-point swing = 1,000 × $0.00002 × 0.001 = $0.02. With a $20 demo and 0.10 lot, that same 1,000-point reversal risks $2 (1% of $200).

What to watch:

- Always run the universal formula (Points × Value / point × Lot size) before each trade. If a 100-point swing at 0.01 lot on V25 costs $14.86, and your account is only $100, that’s a 14.86% risk, not 1–2%.

- Review our in-depth lot-size guide for every index’s exact min/max and point values:

➡️ Synthetic Indices Lot Sizes on Deriv - Demo-test with your intended live balance: If you plan to trade $50 live, run your lot-size math and practice on a $50 demo—don’t use a $5,000 demo and expect the same results.

By mastering Deriv synthetic indices lot sizes and aligning your margin to your risk tolerance, you’ll avoid the fast-track to “Account Wiped” and trade with confidence.

6. Limited Regulatory Oversight (synthetic indices regulation)

Why it matters: Real-world assets like stocks or forex are regulated by bodies such as the FCA, ASIC, or NFA. Synthetic indices, however, are Deriv’s proprietary products—no central regulator audits every trade in real time.

- Impact on you: While Deriv publishes auditor reports on randomness, there’s no third-party guarantee of fair execution or capital protection. If Deriv changes margin rules or discontinues an index, there’s little recourse.

- What to watch: Keep abreast of Deriv’s audit releases and licensing disclosures. Always withdraw profits promptly, and never keep large balances idle if you’re concerned about platform risk.

7. Potential for Higher CFD Fees (synthetic indices CFD fees)

Why it matters: Synthetic indices are offered as CFDs (Contracts for Difference). Holding overnight or using multiplier products can incur swap rates or funding fees that quietly erode your profits.

- Impact on you: A swing trade that looks profitable on the chart can turn into a break-even or losing trade once overnight funding fees are charged.

- What to watch: Check the swap/funding rates for each index in the MT5 “Specification” tab or DTrader’s info panel. When you hold beyond daily cut-offs, factor those costs into your risk-reward.

🔄 Curious How Synthetic Indices Stack Up Against Forex?

Synthetic indices come with unique pros and cons—but what if you want a side-by-side comparison with traditional forex trading?

👉 Dive into the full breakdown here:

Synthetic Indices vs Forex – Key Differences You Should Know

If you’re torn between the two, that guide will give you the clear, data-driven insights to decide which path suits your style.

🧩 So, Should You Trade Synthetic Indices From Deriv?

If you’re still on the fence, here’s the raw truth—synthetic indices can be a powerful addition to your toolkit, but only if you invest the time to learn them inside out.

These aren’t gimmicks.

They run 24/7, follow algorithm-driven patterns, and reward traders who nail the timing and lot sizing. Over the years, I’ve seen full-time traders build solid incomes from Boom & Crash breakouts, V75 scalps, and even the slow-but-steady tortoises like Crash 1000.

Popularity speaks volumes.

From 2016’s handful of V75 fans to today’s bustling WhatsApp groups and YouTube channels, these markets keep growing—especially in Africa and India.

Newbies love the low capital requirements, predictable volatility windows, and the ability to demo-test every strategy without news-driven whipsaws. Veterans stick around for the razor-thin spreads, high leverage, and the chance to trade around the clock.

But let’s be real— there are trade-offs.

Single-broker exposure means Deriv sets the rules. Algorithm tweaks can flatten swings overnight (remember V75’s layoff over the past two years?).

And without fundamental hedges, you can’t offset a bad trade with a correlated asset. If you fail to master lot sizing or ignore session heatmaps, one wrong 0.01 lot on V100 could wipe your micro-account in seconds.

So here’s my advice:

- Demo Trade First—Use the exact balance and lot sizes you plan to go live with.

- Master Lot Sizing & Session Timing—Lean on our formulas and session maps so you know your dollar risk and the best windows to trade.

- Track Every Trade—Keep a journal to spot patterns (or blind spots) before they cost you real money.

- Stay Informed—Watch for Deriv’s algorithm updates and keep an eye on new contenders like Weltrade.

For me? I’ll be trading these synthetic instruments for the foreseeable future—they’re my go-to for precision and profit potential. And if you follow the steps above, they could be your secret weapon too.

Got a thought, a war story, or a strategy that’s working? Drop it in the comments below and let’s keep sharpening our edge together.

FAQs

No, synthetic indices are simulated markets that are not affected by the news or other fundamental events like wars.

Synthetic indices offer 24/7 trading with predictable, algorithm-driven volatility, allowing you to plan entries without worrying about news-driven gaps or market closures. They also require low capital and have tight spreads, making them accessible for both beginners and small-account traders.

Synthetic indices are only available through Deriv, so you face single-broker risk and platform dependency. Additionally, algorithm updates can alter volatility suddenly, and there’s no fundamental hedging option, increasing the potential for rapid losses if you mismanage leverage.

💼 Recommended Brokers to Explore

Other Posts You May Be Interested In

6 Best Copy Trading Brokers 2024: Profit From Social Trading 📈💡

📅 Last updated: December 1, 2023 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Taylor [...]

Comprehensive Guide To Step Index Trading

📅 Last updated: May 22, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Taylor [...]

Best Volatility Indices for Beginners on Deriv (2025 Guide) 🌟

📅 Last updated: June 23, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Taylor [...]

HFM Cent Account Review: Start Trading With A Small Deposit 🧾

📅 Last updated: October 31, 2023 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Taylor [...]

AvaTrade Review 2024: 🔍Is AvaTrade a Good Forex Broker?

📅 Last updated: December 9, 2023 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Taylor [...]

Best Days & Times to Trade Synthetic Indices on Deriv in 2025 🕰️

📅 Last updated: July 10, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Taylor [...]