Not every trading session calls for white-knuckle volatility—sometimes you need a calmer pace to spot reliable setups without the noise. In those moments, the least volatile synthetic indices on Deriv — whether you prefer Boom/Crash, Step, or Volatility Indices — offer just enough movement to keep things interesting while letting you focus on your edge. […]

Category Archives: Synthetic Indices

Back in 2016 I stumbled onto Deriv’s synthetic indices and thought, “Trade 24/7 with zero news noise? I’m in.” As a forex-and-binary options guy, the idea of pure algorithm-driven markets sounded both crazy and brilliant. Nearly a decade later, I’m still trading these things every day—watching new synths launch, old ones retire, and setups evolve. […]

I started trading synthetic indices in 2016. In the ten years since then, I’ve seen a lot. I’ve seen traders start, get burnt, claim Deriv is a scam, and stop trading them completely. I’ve seen fake account managers and scammers. And I’ve also seen traders withdraw thousands upon thousands of dollars from synthetic indices. On […]

Back in 2014, I started trading forex and binary options, and the inability to trade over the weekend drove me nuts—I had to sit on the sidelines until Monday. There simply weren’t alternatives, so I just had to live with the downtime. Then in 2016, synthetic indices hit the scene and offered true 24/7 trading. […]

It is easy to verify your Deriv account — but only if you follow the exact requirements. I’ve been through it. Back in 2017 when I first uploaded my documents, I got rejected twice. Not because Deriv was being unfair — I just didn’t upload what they were asking for. In this guide, I’ll walk […]

Are you interested in trading Deriv synthetic indices? In this guide, I will show you step-by-step instructions on how to open a real Deriv synthetic indices account. First, let’s briefly look at what synthetic indices are. What Are Synthetic Indices? Synthetic indices are trading instruments developed by Deriv that copy the movement of traditional markets […]

Crash indices are exclusive trading assets offered by Deriv. They are a type of synthetic indices. You can use the 3 pips strategy to grow your account with minimum risk steadily. If you do not have a synthetic indices account you can quickly open one here. Indicators to Use For The 3 Pips Synthetic Indices […]

The Volatility index 75 (V75) is one of the most popular trading instruments on Deriv. It has consistently high volatility which presents chances for huge profits even in a short space of time. I have been scalping V75 with great results for more than five years now, and in this guide, I will teach you […]

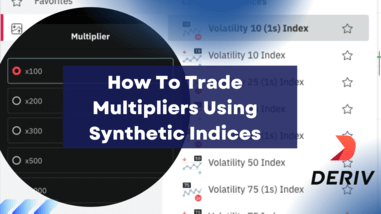

What Are Multipliers From Deriv? Multipliers from Deriv offer a great way of limiting risk and increasing potential profits from your trades. When the market moves in your favour, your potential profits will be multiplied. If the market moves against your prediction, your losses are limited only to your stake. For example, let’s suppose you […]

What Is Deriv X Deriv X is a CFD trading platform that lets you trade various assets in multiple markets like forex, commodities, and cryptocurrencies simultaneously. This article will show you how to trade synthetic indices on Deriv X. These are the steps you follow: Create A Deriv X Account You will need to create […]