Over the past 9 years, I’ve opened and tested every Deriv account type — from my old-school Synthetic-only account in 2016, to experimenting with cTrader and Deriv X more recently. And I’ll tell you right now:

The account you choose really does affect your execution, strategy, and flexibility.

But don’t overcomplicate it. This guide gives you the real differences that matter. Whether you trade forex, synthetics, or metals — there’s an account built for you.

Let’s break them down.

Read Review

OPEN AN ACCOUNT

Read Review

OPEN AN ACCOUNT

Min Deposit: USD 1

Total Pairs: 100+

Regulators: MFSA, LFSA, VFSC, BVIFSC

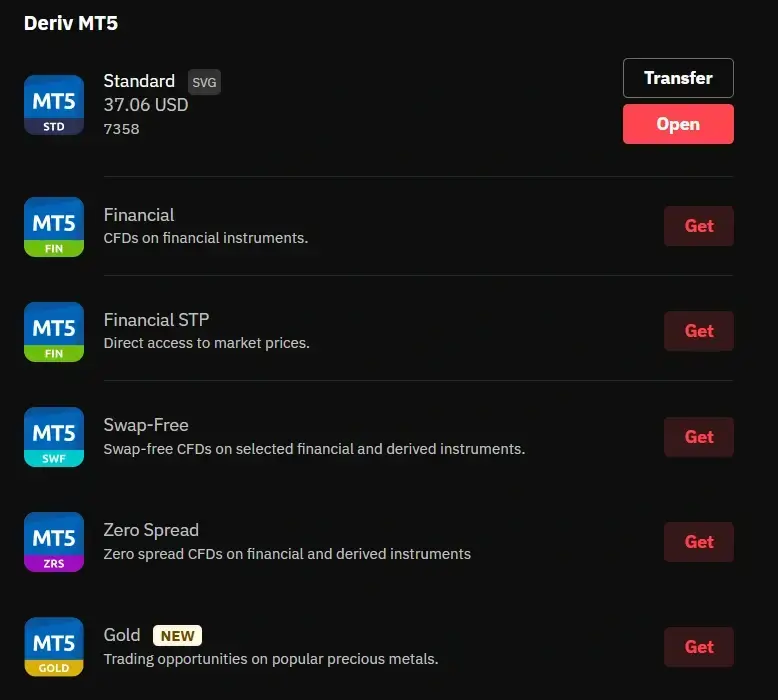

Deriv Account Types (2025 Update)

As of 2025, there are six main MT5 account types you can choose from:

- Standard (previously known as the Synthetic Indices account)

- Financial

- Financial STP

- Swap-Free

- Zero Spread

- Gold (yes, a dedicated account just for trading gold)

On top of that, you’ve also got access to the Deriv X platform and cTrader, depending on your preference.

Each of these accounts comes with a demo version — so before risking a single cent, you can test-drive the conditions and see what fits your trading style.

Let’s break them down one by one…

Let’s look at each account type in depth below.

My Ride-or-Die Since 2016: Deriv Standard Account (ex-Derived Account)

I started with this account back when synthetics were the only thing Deriv offered. It was originally called the Synthetic Indices Account, then renamed Derived, and now it’s simply called the Standard Account.

Even today, it’s still my main account for Boom, Crash, V75, Range Breaks, and even forex. It’s flexible, reliable, and gives access to almost everything in one place.

If you’ve ever wondered whether it’s possible to trade forex and synthetic indices like V75 from a single account—this is your solution.

You can trade:

- Synthetic indices (V75, Boom, Crash, Range Break etc.)

- Forex, crypto, stock indices

- Commodities, ETFs

Why I Stick With It

- 1:1000 leverage

- No commissions

- Only $5 to start, good even for beginners.

- Available on MT5, Deriv X, Deriv EZ, and cTrader

Best For: Traders who want full access to synthetics and forex from one wallet. Especially useful if you flip between markets or run bots.

🔍 Quick Look: Deriv Standard Account Specs

| Feature | Details |

|---|---|

| ⚖️ Leverage | Up to 1:1000 |

| ⚠️ Margin Call | 100% |

| 🚫 Stop Out Level | 50% |

| 💵 Minimum Deposit | $5 |

| 💳 Commissions | None |

| 📲 Platforms | MT5, Deriv X, Deriv EZ, cTrader |

| 📊 Markets Available | Synthetic Indices, Forex, Commodities, Cryptocurrencies, ETFs, Stock Indices, Basket Indices |

| 🧾 Open Account | 👉🏾 Click Here |

Want to Skip Overnight Interest? Deriv Swap-Free Account Review

I activated this on one of my live profiles when I started holding overnight trades more regularly.

No swaps means no interest charges — great for Islamic traders or anyone avoiding compounding rollover fees.

Important: After a few days, an admin fee kicks in. It’s not a loophole for long-term holding.

You still get:

- Forex, crypto, commodities, indices

- $5 minimum deposit

- MT5 only

Note: You have to request this account from your dashboard — it’s not automatic.

Ideal For: Overnight traders, Islamic finance users, and those who don’t trade synthetics.

| ✅ What You Get | ⚠️ What to Watch |

| No overnight interest (swap-free compliance) | Admin fee after holding > 3 days |

| Works with forex, crypto, indices | No access to synthetic indices |

| Same $5 deposit and 1:1000 leverage | Requires manual activation request |

Deriv Swap-Free vs Standard Account: Key Differences

| Feature | Standard Account | Swap-Free Account |

| Overnight Charges | Yes (Swap applied) | No (Admin fee after 3+ days) |

| Synthetic Indices Access | Yes | No |

| Target User | General traders | Islamic finance / Swing traders |

| Supported Markets | All, including synthetics | Forex, crypto, indices only |

If you’re trading Boom & Crash or V75, the Standard Account is your best bet. But if you avoid overnight interest for religious or strategy reasons, go with the Swap-Free Account—just remember there’s an admin fee after a few days.

Precision and Clean Fills: Deriv Financial Account Review

The Deriv Financial Account is specifically tailored for traders who want to exclusively focus on traditional financial markets such as forex, commodities, cryptocurrencies, and stock indices—excluding synthetic indices entirely.

This is the go-to account if your primary interest lies in trading real-world financial instruments.

When I shifted more toward forex trading, especially during news releases, I started using the Financial Account.

No synthetics here. Just solid execution on majors, minors, commodities, crypto, and indices.

Why It Works for Me

- Slightly tighter spreads on majors like EURUSD

- 1:1000 leverage

- No commission

- MT5 only

Ideal For: Forex traders who don’t want distractions. If you trade around news or follow gold, oil, BTC, or US500 trends — this is your space.

Want to compare Synthetics vs Forex? Here’s my guide

Key Features at a Glance Deriv Financial Account

- ⚖️ Leverage: Up to 1:1000 (varies by asset)

- 💳 Minimum Deposit: $5

- 🔁 Commissions: None

- 📉 Markets: Forex, Crypto, Stock Indices, Commodities

- 🛠️ Platform: MT5 only

- 🚫 No synthetics: This account is strictly for real-world assets.

Deriv Financial STP Account Review

This one’s often misunderstood. STP means “Straight Through Processing” — your orders go straight to liquidity providers.

I used it to test some scalping bots on EURUSD, and fills were smooth. No re-quotes, no delays.

Key Highlights

- Only major forex pairs

- Leverage capped at 1:100

- MT5 only

- 0 commissions

Not for everyone, but if you’re running EAs, scalping the majors, or testing tight-SL strategies, this is your pro-level account..

Keep in mind this account exclusively supports forex pairs and does not cover other markets such as gold, cryptocurrencies, indices, or synthetic indices. It’s streamlined and specifically tailored for forex majors.

This account is highly recommended if you’re operating trading bots, employing tight risk management, or seeking the cleanest trading conditions specifically for major forex pairs.

However, if you prefer a wider market selection or you’re still building your trading skills, the Financial or Standard accounts might be more appropriate options.

📊 Deriv Financial Account vs Financial STP Account

| Feature | Financial Account | Financial STP Account |

| 🔁 Execution Model | Market Maker | Straight-Through Processing |

| ⚖️ Leverage | Up to 1:1000 | Up to 1:100 |

| 🎯 Asset Coverage | Forex, Crypto, Indices | Forex Majors Only |

| 💰 Commission | None | None |

| 🛠️ Platform | MT5 only | MT5 only |

Deriv Zero Spread Account

The Deriv Zero Spread Account is specifically designed for traders who demand ultra-tight pricing, especially beneficial for scalpers, high-frequency trading bots, and manual traders needing precise entries and exits.

I personally tested this account extensively during a period of scalping forex majors around news events. The tight pricing was highly advantageous during fast-paced trading sessions. However, like all specialized accounts, there is a trade-off to consider.

With the Zero Spread Account, Deriv removes spreads entirely on certain instruments, replacing them with a fixed commission per trade. Although the commission isn’t prohibitively high, it can quickly accumulate if you frequently enter and exit positions.

Deriv Zero Spread Account Features

- 📉 Spread: Zero on selected forex majors

- 💰 Commission: Fixed per lot (instead of spread)

- ⚖️ Leverage: Up to 1:1000

- ⚡ Execution: Fast and clean, ideal for bots and EAs

- 📊 Markets: EURUSD, GBPUSD, USDJPY only

- 🛠️ Platform: MT5 only

- 🚫 Not for long-term trades or variety-seekers

If your strategy focuses on scalping major pairs during volatile sessions or operating fast-paced automated trading systems, this account is perfect.

However, for traders still learning or those seeking broader asset options and lower entry costs per trade, the Standard or Financial accounts might provide a better starting point.

Deriv Gold Account

If your entire strategy revolves around gold, silver, or platinum, this niche Gold Account gives tighter spreads and focused conditions.

I used this during a stretch of XAUUSD day trading and noticed improved entry conditions.

Assets Available

- Gold (XAU/USD)

- Silver (XAG/USD)

- Platinum, Palladium

Best For: Precious metal specialists. Don’t open this if you want synthetics or forex access.

Deriv Gold Account At A Glance

- ⚖️ Leverage: Up to 1:1000

- 💳 Minimum Deposit: $5

- 🛠️ Platform: MT5 only

- 📊 Markets: Gold (XAUUSD), Silver, Platinum, Palladium

- 📈 Specialization: Optimized spreads and execution for metals only

- 🚫 No forex, crypto, or synthetics supported

Deriv cTrader Account

When Deriv introduced cTrader in 2023, I was genuinely impressed. Having primarily used MT5 since 2016, the cTrader platform immediately stood out to me due to its modern interface, enhanced charting capabilities, and integrated advanced trading features.

It’s tailored for traders seeking precision, sophisticated tools, and seamless copy trading.

- 💻 Platform: cTrader only (not MT5-compatible)

- 💳 Minimum Deposit: $5

- 📊 Markets: Forex, crypto, commodities, indices

- 🧠 Extras: Built-in copy trading, sentiment data, and cAlgo automation tools

Best For: Traders who want visual control, automation tools, and better charting. Especially those tired of the MT5 layout.

Deriv X Account

This is Deriv’s in-house platform and it’s honestly impressive. Clean UI, drag-and-drop modules, and easy trade execution — especially on mobile.

I use it when I’m away from my desk and still want to monitor trades or place quick entries.

Supports:

- Standard, Financial, and Swap-Free accounts

- Boom & Crash, V75, Forex, Crypto, and more

Why I Like Deriv X (and What You Should Know)

One of the biggest advantages of Deriv X is its browser-based setup — you don’t need to download any software.

Whether you’re on your laptop or phone, it runs smoothly right from your browser or mobile app. The platform is built for multitasking, with features like split-screen layouts, drag-and-drop widgets, and fast execution that make it ideal for active traders.

What really stood out for me was the mobile experience.

Unlike MT5 mobile — which often feels clunky — Deriv X is designed with mobile users in mind. Charting and trade management are intuitive and fast, even on smaller screens.

The interface itself is modern and easy to navigate, especially if you’re just starting out. You also get full access to synthetics, forex, crypto, commodities, and more — all from one place — with risk management tools like SL/TP placement integrated into the trade panel.

That said, Deriv X isn’t perfect. It doesn’t yet support custom indicators or automated trading like MT5 or cTrader, and while it’s improving fast, it still lacks the deep customization that veteran traders might expect.

It also doesn’t work with some account types like the Financial STP or Gold accounts — so double-check before you commit.

Overall, if you’re trading on mobile or just want a cleaner, simpler experience, Deriv X is worth testing.

- 🌐 Access: Web and mobile (no download required)

- ⚖️ Leverage: Up to 1:1000

- 💳 Minimum Deposit: $5

- 🧠 Best For: Visual traders, mobile-first users, and beginner-friendly execution

- 📊 Markets: Synthetics, forex, crypto, ETFs, commodities

- 🚫 No support for STP or Gold accounts

In addition, Deriv offers a Demo account for each of these accounts for free to help beginners trade and test out the account features. You can get instructions on how to open a Deriv demo account here.

Does Deriv Have Micro or Cent Accounts?

No, Deriv does not offer micro or cent accounts. However, you can trade with as little as 0.001 lot size, which functions similarly to a micro setup, especially when combined with the low $5 deposit.

Alternative: Use the Standard Account with minimal position sizes. It allows smaller trades while still maintaining the same execution quality.

Deriv Account Types Minimum Deposit Breakdown

- Standard: $5

- Financial: $5

- Financial STP: $5

- Swap-Free: $5

- Zero Spread: $5

- Gold: $5

- cTrader: $5

- Deriv X: $5

Note: Some payment methods require higher deposits. See full deposit methods by country

✅ Which Deriv Account is Best for You? (Based on Trader Type)

Deriv offers several MT5 account types — and the best one for you depends on what you trade, how often, and your experience level.

After testing all of them personally, here’s a no-fluff breakdown of which account suits which trader:

🔰 Beginner or Casual Traders

Recommended: Standard Account or Deriv X

Why: Low $5 deposit, user-friendly platform, wide market access including synthetics, forex, and crypto. Deriv X is mobile-first and beginner-friendly.

💥 Synthetic Indices Traders (V75, Boom, Crash, Step Index)

Recommended: Standard Account

Why: Full access to Deriv’s synthetic assets 24/7 + forex, crypto, and commodities. My personal go-to since 2016.

📊 Forex, Gold, Oil, Crypto & Stock Index Traders

Recommended: Financial Account

Why: Ideal for real-world assets — tighter spreads on majors, metals, and global indices. Great for news/event-driven forex strategies.

👉 Still deciding between trading forex or synthetics?

Check out this detailed comparison to see how the two stack up in terms of volatility, risk, strategy, and trading hours:

Synthetic Indices vs Forex – Which One Should You Trade?

It’ll help you decide whether the Financial Account or Standard Account suits your goals better.

⚡ Scalpers & EA Users (Tight SL/TP setups)

Recommended: Financial STP or Zero Spread Account

Why: Direct market access, minimal latency, zero spreads on majors, and clean execution—perfect for bots and high-frequency trading.

🤝 Copy Traders & Passive Income Seekers

Recommended: cTrader Account

Why: Built-in copy trading, no third-party apps needed. Also supports algo bots and advanced charting.

🌙 Islamic Traders / Overnight Swing Traders

Recommended: Swap-Free Account

Why: No overnight interest (swap-free). Supports forex, crypto, and indices. Great for Shariah-compliant or rollover-sensitive strategies.

🪙 Precious Metals Specialists

Recommended: Gold Account

Why: Optimized for XAU/USD, XAG/USD, and other metals. Tighter spreads and high leverage for focused metal trading.

🎯 Quick Summary: Which Deriv MT5 Account Is Best?

| Trader Type | Best Account | Highlights |

|---|---|---|

| Beginner / Mobile Trader | Standard / Deriv X | Easy to use, low deposit, access to all major markets |

| Synthetic Index Specialist | Standard | V75, Boom & Crash, Step Index, 24/7 access |

| Forex & Economic News Trader | Financial | Real-world assets with tighter spreads |

| Scalper / High-Frequency EA Trader | STP / Zero Spread | Fast execution, raw pricing |

| Copy Trader / Strategy Follower | cTrader | Built-in copy tools, strategy marketplace |

| Islamic Trader / Swap Sensitive | Swap-Free | No interest, flat admin fee instead |

| Gold / Metals Trader | Gold | Focused metal trading with optimized spreads |

🔁 Deriv Currency Accounts Explained

If you’re looking to trade forex on Deriv, you’ll want to open a Deriv currency account — this refers to either the Financial Account (for broader forex access) or the Financial STP Account (for direct market execution on major currency pairs like EUR/USD, GBP/USD, and USD/JPY).

Both accounts allow you to trade real-world currencies with tight spreads and high leverage.

You’ll also choose your account’s base currency (USD, EUR, etc.) during setup — this affects how your profits and balances are calculated, but doesn’t limit what currency pairs you can trade.

🔍 What Is Deriv Leverage?

Leverage on Deriv allows you to control larger trade sizes with a smaller deposit. It’s expressed as a ratio — like 1:1000, which means you can open a position worth $1,000 with just $1 of your own capital.

📈 Deriv Leverage by Account Type (2025)

| Account Type | Max Leverage | Notes |

|---|---|---|

| Standard | Up to 1:1000 | Best for synthetics and multi-market traders |

| Financial | Up to 1:1000 | Higher leverage for forex, crypto, indices |

| Financial STP | Up to 1:100 | Safer leverage, direct market access for forex majors |

| Swap-Free | Up to 1:1000 | Designed for Islamic traders and overnight setups |

| Zero Spread | Up to 1:1000 | High leverage + zero spread on select forex pairs |

| Gold | Up to 1:1000 | Metals-focused with flexible margin |

| cTrader | Up to 1:1000 | Leverage varies by instrument, optimized for forex |

| Deriv X | Up to 1:1000 | Available across all supported assets |

⚠️ Always use leverage responsibly — high leverage magnifies both profits and losses. Start small if you’re new.

How To Open A Deriv Account

Opening a Deriv account is straightforward, especially if you’ve previously used any online broker. However, to ensure a smooth and error-free setup, here’s a concise, clear guide to get you started quickly:

- Visit the Deriv Account Sign-Up Page:

- Click on “Create free demo account.“

- Click on “Create free demo account.“

- Register Your Email:

- Enter a valid email address and confirm it via the verification link Deriv sends you.

- Enter a valid email address and confirm it via the verification link Deriv sends you.

- Set Up Your Account Details:

- Select your country of residence and create a secure password. These steps confirm your jurisdiction and regulatory compliance.

- Select your country of residence and create a secure password. These steps confirm your jurisdiction and regulatory compliance.

- Choose Your Real Account Preferences:

- Log into your Deriv dashboard and select “Add a Real Account.”

- Select your preferred base currency (USD recommended).

- Choose your trading platform (MT5, Deriv X, or cTrader).

- Select your desired account type (Standard, Financial, STP, Swap-Free, Gold, etc.).

- Verify Your Identity:

- Upload your government-issued ID and proof of residence promptly, as these documents are required for deposits and withdrawals.

- Upload your government-issued ID and proof of residence promptly, as these documents are required for deposits and withdrawals.

- Fund and Trade:

- After verification, your real account will appear under the “My Accounts” section. Fund it to start live trading.

👉 For a detailed step-by-step guide with screenshots specifically tailored to the Standard (Synthetic) Account, refer to this post:

Understanding Deriv’s Jurisdictions for MT5 Accounts

Deriv operates under several regulatory jurisdictions to comply with international financial standards. When creating a Deriv MT5 account, you’ll be prompted to select a jurisdiction, which determines the regulatory framework governing your account.

Here’s a breakdown of the main jurisdictions Deriv operates under:

🇲🇹 Malta (EU)

- Regulator: Malta Financial Services Authority (MFSA)

- Region: European Union

- Key Benefit: Operates under ESMA regulations, offering high regulatory oversight and protections for EU-based clients.

🇻🇬 British Virgin Islands (BVI)

- Regulator: BVI Financial Services Commission (BVIFSC)

- Region: Global (Non-EU)

- Key Benefit: Allows broader international access, including Asia and other non-EU territories, with more flexible trading conditions.

🇲🇾 Labuan, Malaysia

- Regulator: Labuan Financial Services Authority (Labuan FSA)

- Region: Southeast Asia

- Key Benefit: Offers competitive trading conditions and access for Asian traders under Malaysia’s offshore regulatory framework.

🇮🇲 Isle of Man

- Regulator: Isle of Man Gambling Supervision Commission

- Region: Global

- Key Benefit: Primarily oversees financial products with certain protections; more niche but useful for specific account setups.

Each of these jurisdictions enforces different levels of regulatory control and client protections. Your choice will impact elements such as leverage limits, spread types, and tax implications. This flexibility allows Deriv to serve a wide range of global traders while maintaining regulatory compliance.

Before selecting, it’s worth reviewing your regional requirements and trading goals to choose the jurisdiction that aligns best with your needs.ryptocurrencies. Each jurisdiction may have its own set of rules and protections for traders, ensuring compliance with local laws and regulations.

How to Choose the Right Jurisdiction for Your Deriv MT5 Account

Selecting the appropriate jurisdiction for your Deriv MT5 account is a key decision that can significantly influence your trading experience. Jurisdiction affects everything from regulatory protections and available instruments to fees, leverage, and even tax exposure. Here’s a clear breakdown of what to consider:

🏛️ Regulatory Environment

Different jurisdictions come with different levels of oversight. If strong investor protection and regulation are your priorities, opt for a well-established regulatory body like MFSA (Malta). More relaxed jurisdictions may offer higher leverage but with fewer safeguards.

🌍 Market Access

Ensure the jurisdiction allows access to the financial instruments you intend to trade. Some restrict specific assets while others provide broader access to forex, crypto, commodities, indices, and synthetics.

💸 Tax Implications

Tax treatment of trading profits varies by region. Research how capital gains and trading income are taxed and choose a jurisdiction that aligns with your personal or business tax strategy.

💰 Spreads, Costs & Fees

Different jurisdictions come with different trading conditions. For example:

- Vanuatu: Offers spreads as low as 0.5 pips on Financial accounts.

- Labuan (Malaysia): Spreads start from around 1.4 pips.

Also check for additional account maintenance or regulatory fees that might affect your long-term profitability.

🏛️ Legal & Political Stability

Political or legal instability can disrupt markets and regulatory structures. Choosing a stable jurisdiction helps protect your assets and ensures consistent broker operations.

📞 Support & Client Service

Quality support varies by jurisdiction. In high-volatility markets, access to quick and efficient customer service becomes essential—especially during issues with deposits, withdrawals, or trade execution.

🎯 Personal Strategy & Preferences

Some traders value strict regulation and security, others prioritize higher leverage or access to niche instruments. Your trading goals should guide your jurisdiction selection.

Before finalizing, take time to:

Compare jurisdictions side by side

- Read the fine print for each account type

- Consult a financial advisor if you’re unsure

Making the right jurisdiction choice at the start ensures smoother operations, better trading conditions, and long-term flexibility as you grow your account.make an informed decision that supports your trading objectives and ensures a secure and compliant trading environment.

Conclusion on Deriv Account Types Review

Over the years, I’ve opened and tested every Deriv account type—and here’s what I’ve learned: the account you choose plays a bigger role than most traders realize. It determines the markets you can access, how your trades are executed, and how fees impact your profitability.

The best part? You’re not locked into a single choice. Deriv allows you to create multiple accounts under one login, so you can adapt as your strategy evolves.

The key is not to overthink it. Start with the account that best fits your current trading plan. You can always explore other options later.

And if you ever feel stuck or need guidance, that’s exactly why these detailed reviews and guides exist.

Still unsure which account fits your style? Leave a comment or reach out — I’m here to help. 💬

Read Review

OPEN AN ACCOUNT

Read Review

OPEN AN ACCOUNT

Min Deposit: USD 1

Total Pairs: 100+

Regulators: MFSA, LFSA, VFSC, BVIFSC

🔗 Related Resources You Might Like

📈 Compare Deriv Platforms (MT5 vs cTrader vs Deriv X)

A hands-on breakdown of Deriv’s platforms — which one suits bots, scalping, mobile trading, or passive income?

💳 How to Deposit & Withdraw Using Deriv Payment Agents

Skip card or crypto delays. See how local payment agents work, and how to find one in your region.

📊 Best Time to Trade Volatility Indices on Deriv

Want cleaner setups and less whipsaw? This guide breaks down when the market moves best — by day, hour, and session.

💡 3 Pips Synthetic Indices Strategy

An ultra-simple strategy designed for small accounts trading Boom, Crash, and Step Index.

📞 How to Contact Deriv Support

Stuck or need help verifying your account? Here’s how to reach real human support — live chat, email, and region-specific contacts.

Frequently Asked Questions On Deriv Account Types

Deriv offers Standard, Financial, Financial STP, Swap-Free, Zero Spread, and Gold accounts. Each caters to different markets and trader types.

Yes, it is possible to switch between different account types on Deriv.

Yes, you can have more than one account type on Deriv and you can switch between the different accounts.

Deriv offers leverage up to 1:1000, depending on your account type and region. Financial STP is capped at 1:100 for risk control.

All account types on Deriv start from just $5. Some regions may offer lower minimums (as low as $1) depending on payment methods.

It depends on your strategy. Standard is best for synthetics, Financial for forex and gold, STP for scalping majors, and Swap-Free for overnight traders.

A “currency account” refers to either a forex trading account (like the Financial or STP account) or the base currency you choose (USD, EUR, etc.) when creating your account.

Absolutely. Deriv lets you manage multiple MT5 accounts from one dashboard for different strategies.

💼 Recommended Brokers to Explore

Other Posts You May Be Interested In

Deriv Jump Indices: A Comprehensive Beginners Guide (2025) 📊

📅 Last updated: June 26, 2025 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Taylor [...]

Deriv Wins Most Trusted Global Broker at The UF Awards Global 2024

📅 Last updated: June 21, 2024 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Taylor [...]

FBS Review 2024 🔍 Is It A Good Broker?

📅 Last updated: December 11, 2023 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Taylor [...]

AvaTrade Account Types Review 2024: 🔍 Which One Is Best?

📅 Last updated: December 8, 2023 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Taylor [...]

Exness Account Types Review 2024 🔍A Comprehensive Guide

📅 Last updated: December 7, 2023 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Taylor [...]

How To Open A Deriv Real Synthetic Indices Account in 2026 ☑️

📅 Last updated: February 16, 2026 ✍️ Written by: Jafar Omar ✅ Fact-checked by: Taylor [...]